Real Estate Portfolio Examples – How to Build, Manage, and Grow Diverse Property Investments

A real estate portfolio refers to a collection of investment properties owned by an individual or a company. These properties may include residential rentals, commercial spaces, vacation homes, or industrial assets. Each property contributes to the investor’s financial goals, providing a mix of cash flow, appreciation, and tax benefits.

Having a well-balanced portfolio helps reduce risk, enhance income stability, and open opportunities for capital growth. Investors often diversify across locations and property types to optimize returns and protect their investments from market fluctuations.

Why Real Estate Portfolios Matter

Building a real estate portfolio is more than just buying properties; it’s about creating a long-term wealth strategy. Successful investors use their portfolios to generate passive income and leverage equity to acquire new assets.

A robust portfolio provides financial security, allows you to hedge against inflation, and creates a path toward financial independence. By analyzing and tracking each property’s performance, investors can identify which assets deliver the highest returns and which need adjustments or upgrades.

Types of Real Estate Portfolio Examples

1. Residential Rental Portfolio

Residential portfolios typically comprise single-family homes, duplexes, or apartment units. These properties generate steady rental income and typically experience long-term appreciation. Many beginners start with residential properties because they’re easier to finance and manage.

Investors in residential portfolios focus on occupancy rates, rental yield, and property maintenance. They often utilize property management software to efficiently handle rent collection, tenant screening, and maintenance requests.

2. Commercial Property Portfolio

Commercial portfolios include office buildings, retail spaces, and warehouses. These assets usually have higher upfront costs but can yield significant returns through long-term lease agreements. Investors in this category benefit from stable cash flow and potentially higher ROI compared to residential investments.

However, commercial real estate also requires more market knowledge and due diligence. Factors like location, tenant type, and economic trends play crucial roles in determining profitability.

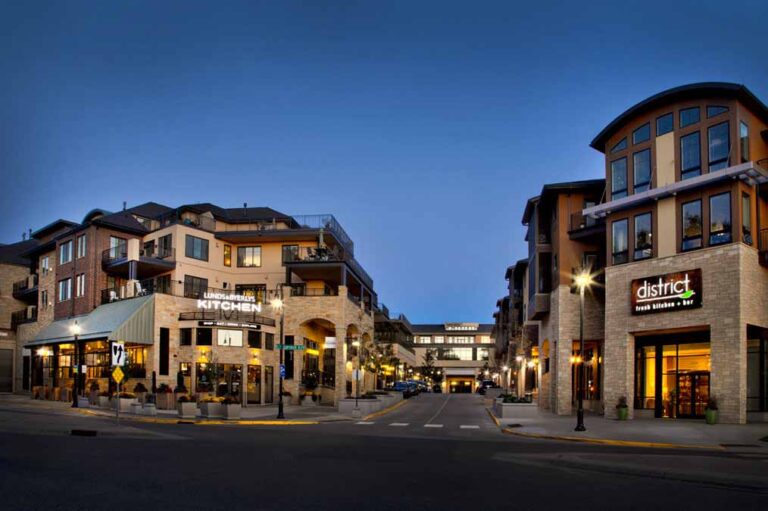

3. Mixed-Use Property Portfolio

A mixed-use portfolio combines residential and commercial properties within a single investment or multiple holdings. For instance, an investor might own an apartment complex with ground-floor retail stores.

This model allows investors to enjoy multiple income streams while minimizing the risks associated with a single property type. It’s a popular approach in urban areas where both housing and commercial demand remain strong.

4. Vacation Rental Portfolio

With the rise of platforms like Airbnb, many investors now include short-term rentals in their real estate portfolios. Vacation homes or serviced apartments in tourist destinations can yield high seasonal profits.

The key to success lies in effective management from maintaining property standards to ensuring strong online visibility through digital platforms. Some investors use automated pricing tools to maximize occupancy and nightly rates.

Real-World Examples of Real Estate Portfolios

Blackstone Group’s Global Portfolio

ST?wid=1280&hei=548)

Blackstone is one of the world’s largest real estate investment firms. Their portfolio includes a mix of commercial properties, logistics centers, and residential complexes across continents. Their success lies in diversification and data-driven decision-making, showing how large-scale property management can yield long-term profitability.

Local Investor with a Residential Focus

Many small-scale investors start with local properties. For example, an investor owning three apartment buildings in one city can use rental income to refinance and purchase additional properties. Over time, this approach helps grow a sustainable portfolio with consistent cash flow.

REIT (Real Estate Investment Trust) Portfolios

REITs offer investors the ability to hold diversified real estate assets without direct ownership. Companies like Prologis or Simon Property Group manage thousands of assets worldwide, and their structures provide valuable lessons for private investors seeking diversification, liquidity, and scalability.

Benefits of Building a Real Estate Portfolio

Creating a property portfolio brings numerous benefits beyond financial gain. Here are a few key advantages:

- Diversification of Risk: Holding various property types in different locations minimizes exposure to localized market downturns.

- Steady Cash Flow: Rental income from multiple sources ensures a consistent monthly return.

- Appreciation Potential: Real estate generally appreciates over time, growing your asset base.

- Tax Advantages: Property owners can benefit from deductions like mortgage interest, depreciation, and maintenance costs.

- Wealth Leverage: Equity in properties can be used to secure additional investments or loans.

How Technology Supports Real Estate Portfolio Management

Advancements in technology have revolutionized how investors manage their portfolios. Property management software, AI-driven analytics, and blockchain-based systems are streamlining everything from tenant management to transaction transparency.

For instance, tools like Buildium or AppFolio allow investors to track income, expenses, and occupancy rates in real time. Meanwhile, predictive analytics tools help assess market trends and forecast property performance, supporting smarter investment decisions.

Practical Use Cases of Real Estate Portfolios

Real estate portfolios solve many practical problems for investors. They help balance income streams, mitigate risk, and create long-term stability. Here are a few common use cases:

- Retirement Planning: Investors often rely on their property portfolios to generate passive income during retirement.

- Wealth Diversification: A real estate portfolio acts as a hedge against volatile stock markets.

- Legacy Building: Properties can be passed down through generations, ensuring wealth continuity.

- Entrepreneurial Leverage: Some investors use portfolio equity to fund startups or new ventures.

Challenges in Managing a Real Estate Portfolio

While the rewards are significant, managing multiple properties comes with challenges. These include market volatility, tenant management, maintenance costs, and evolving regulations. Investors must stay informed and proactive to maintain portfolio health.

Using digital platforms, hiring experienced property managers, and continuously monitoring performance are key to overcoming these hurdles.

Conclusion

A well-structured real estate portfolio provides financial freedom, stability, and long-term growth potential. Whether you start small with residential units or aim big with commercial investments, the principles remain the same diversify, manage efficiently, and leverage technology to maximize results.

FAQ

- What is a real estate portfolio?

A real estate portfolio is a collection of property investments owned by an individual or company to generate income, appreciation, or both. - How do I start building a real estate portfolio?

Start by setting clear financial goals, securing financing, and investing in properties with strong rental demand or growth potential. - What are the best types of properties to include in a portfolio?

It depends on your strategy. Residential and commercial properties offer stability, while vacation rentals and REITs provide diversification and higher potential returns.