How to Build & Grow a Real Estate Portfolio: Strategies & Insights

A real estate portfolio simply refers to the collection of property assets, residential, commercial, and land that an individual or institution owns for the purpose of generating income, capital appreciation, or both. In essence, it’s not just owning one property or two, but strategically holding multiple assets that diversify risk, leverage different markets, and build sustainable wealth.

Beyond the literal aggregation of properties, a real estate portfolio embodies an investment philosophy: how those holdings are structured, how risk is managed, and how value is maximized over time. A passive investor’s portfolio might consist of REITs or real estate funds, while an active investor’s portfolio may include residential rentals, commercial buildings, mixed-use properties, or development projects.

The significance of a real estate portfolio lies in its ability to:

-

Smooth income streams (some properties may underperform briefly, others may overperform)

-

Hedge against market volatility (diversification across geographies, types, and leverage levels)

-

Compound wealth via reinvestment of cash flows and strategic acquisitions

-

Provide leverage advantages (debt can be used strategically to multiply returns)

For many serious real estate investors, the portfolio, not any single property, becomes the true metric of success and resilience.

Core Strategies in Building a Strong Real Estate Portfolio

Diversification Across Property Types and Markets

One of the first rules in portfolio strategy is diversification. You reduce idiosyncratic risk by spreading your assets across different property types (residential, commercial, industrial, land) and across geographies (cities, states, countries). If one submarket softens, say, real estate, your holdings in multifamily or industrial may stay steadier.

When expanding into new markets, investors often perform comparative market analysis, evaluating rent growth, vacancy trends, job growth, population inflows, infrastructure projects, and regulatory stability. By mixing stable “core” assets with higher-growth or value-add opportunities, one can balance safety and upside.

Another dimension is capital structure diversity: some properties may be fully equity-funded, while others have moderate leverage. This variety ensures that interest rate movements or debt availability changes won’t endanger the entire portfolio at once.

Phased Value-Add & Redevelopment Strategies

Beyond mere acquisition, portfolio growth often depends on value-add and redevelopment moves. In this approach, the investor acquires underperforming or distressed properties, injects capital (renovations, repositioning), and increases net operating income (NOI). Once stabilization is achieved, the property becomes a cash cow or is sold at a premium.

This strategy requires deeper operational capability, local market insight, and sometimes more risk tolerance. Still, because the potential returns from repositioning or redevelopment tend to be higher than “buy and hold” in stabilized markets, value-add deals can accelerate portfolio growth.

Another version is serial development or ground-up projects: building new residential or commercial properties to add to the portfolio. These carry higher execution risk but yield high returns if done well.

Use of Leverage, Debt Stacking & Equity Recycling

Leveraging is a double-edged sword, but when managed prudently, it’s a foundational tool in portfolio scaling. Real estate, given its tangible collateral, offers more favorable financing terms compared to many asset classes. Developers and investors often use debt stacking (senior + mezzanine) or refinance existing properties to extract equity, then deploy capital into new acquisitions.

Equity recycling is the practice of refinancing a stabilized property at a higher valuation and pulling cash out, then using those proceeds for new purchases. This accelerates growth without always requiring fresh capital injection.

However, the use of leverage must be paired with rigorous stress-testing: interest rate hikes, vacancy shocks, or cost overruns can turn leverage from an engine into a liability.

Technology & Tools That Amplify Real Estate Portfolio Management

Technology is a major enabler for modern real estate portfolios. Below are critical domains where tech provides a formative advantage.

Portfolio Management Platforms & Analytics

Modern portfolio software gives a consolidated view of all asset performance metrics, cash flows, debt schedules, forecasts, risk dashboards, and scenario modeling. These systems allow investors to spot underperformers, compare markets, and make data-driven buy/sell decisions.

Automated analytics can surface trends like lease expirations, maintenance cost spikes, vacancy forecasts, and comparable property performance. Instead of manual spreadsheets, these platforms deliver agility and scalability.

PropTech Tools (Smart Buildings, IoT, Predictive Maintenance)

Equipping portfolio properties with smart sensors (HVAC, lighting, occupancy) and IoT systems helps reduce operational costs, preempt failures, and improve tenant satisfaction. Predictive maintenance triggered by real-time data can prevent expensive downtime or emergency repairs.

Furthermore, PropTech platforms can optimize energy usage, smart access control, tenant apps, and usage analytics, which in turn boost asset value, tenant retention, and margin.

Market Intelligence & Deal Sourcing AI

Sophisticated AAI/machine-learning systems now scan property listings, off-market deals, auction databases, zoning changes, and demographic shifts to recommend potential acquisitions. Some products also forecast neighborhood growth, price trends, or identify underpriced properties preemptively.

This accelerates sourcing, filters noise, and reduces reliance on manual brokers. The best portfolios integrate that intelligence pipeline into their acquisition workflow.

Real-World Examples & Use Cases

Below are three illustrative real-world examples that help ground theory into reality.

Institutional Multifamily Portfolio in Sunbelt Cities

An institutional real estate fund assembled a portfolio of mid-rise multifamily properties across Sunbelt metro areas (e.g., Austin, Phoenix, Orlando). Their strategy: acquire in cities with strong population migration, job growth, and housing supply constraints. They used moderate leverage, upgraded unit interiors and amenities, then increased rents above market growth by positioning these as premium rentals.

Over five years, the fund recycled equity through refinancing, stabilized assets, and redeployed into secondary cities. The result: a scalable, diversified multifamily platform with both income and capital appreciation. This case exemplifies how combining geographic and property-type diversification with value-add upgrades can yield compounding portfolio growth.

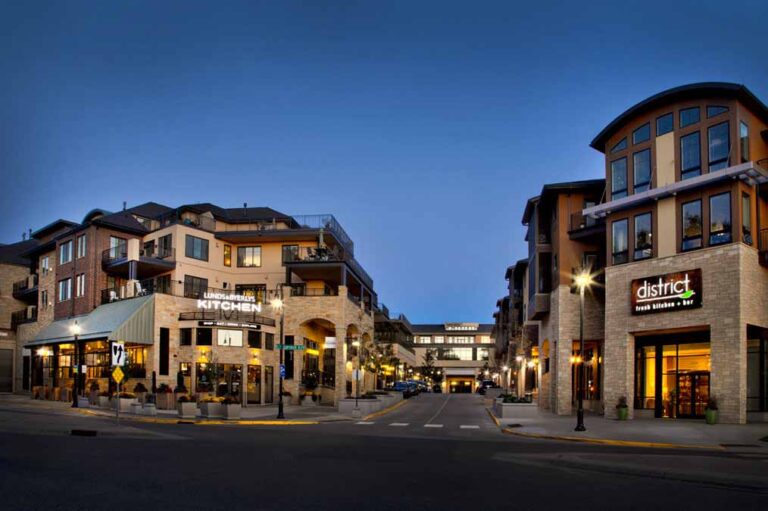

Mixed-use + Retail + Office Conversion Fund

Another portfolio specialized in converting older retail or underutilized ground-floor retail + upper-level offices into mixed-use developments (retail + flexible workspace + residential). They acquired properties in urban infill districts, near transit corridors. By repositioning these assets, adding coworking or boutique residential units, and leasing to F&B or creative tenants, they lifted valuations considerably.

They also used debt stacking for portions under development, and refinanced post-stabilization at lower interest rates. Their approach shows how repositioning and mixed-use strategy can fold into a growth-oriented portfolio.

International Property Investment Portfolio

A high-net-worth investor built a cross-border real estate portfolio: luxury residential units in London, commercial retail in Singapore, and vacation rentals in coastal Spain. The aim was both capital appreciation and currency/market diversification. Each property was locally managed with teams and PropTech systems enabling remote oversight.

This portfolio used local financing in each jurisdiction to hedge against currency risk and deployed equity recycling across markets. The example shows how international diversification, coupled with local execution, can act as a growth and risk mitigation strategy.

Benefits & Practical Advantages of Managing a Real Estate Portfolio

A well-managed real estate portfolio offers many tangible benefits and real-world advantages. Below are detailed explanations:

Stable & Diversified Income Streams

With multiple assets, cash flow fluctuations in one property may be smoothed by steadier performance in others. This reduces income volatility and helps maintain operational resilience, especially during market cycles.

Capital Appreciation & Leveraged Growth

Over time, real estate tends to appreciate (modulo inflation and location variance). Through judicious use of leverage and refinancing, a portfolio can compound value faster than single-asset holdings. By recycling equity and scaling gradually, returns become multiplicative.

Tax Efficiency & Optimization

Portfolios enable investors to span depreciation, cost segregation, 1031-style exchanges (in jurisdictions that allow them), and debt interest deductions. In many legal systems, treating property assets as a consolidated group can unlock efficiencies in taxation, estate planning, and capital gains management.

Economies of Scale & Operational Efficiency

Managing multiple properties gives you leverage in procurement (maintenance, services, insurance), management systems, staffing, and technology overhead. One unified team or platform supporting many assets leads to lower per-unit costs and better centralized decision-making.

Risk Mitigation & Resilience

A diversified portfolio helps mitigate localized shocks market downturns in one city, regulatory changes in one sector, or tenant defaults in one building. Because the portfolio spans asset classes, geographies, and lease types, the overall investment is more robust to external risks.

Use Cases & PProblem-SolvingScenarios

Scenario: You Own One Underperforming Rental

If an investor owns only one rental property and that market cools (vacancy, rent decline), they are exposed to severe cash strain. By building a portfolio across regions and types, the income from other assets cushions the blow, thus avoiding forced sales during downturns.

Scenario: Reinvestment Without Additional Capital

An investor wants to scale but lacks new capital. By stabilizing properties, refinancing at higher valuations, and recycling equity, they free up capital for new acquisitions without external funding. A portfolio-level approach makes that feasible.

Scenario: Hedging Against Market or Regulatory Risk

Suppose a city enacts rent control or property tax hikes. If your entire holdings are in that city, your risk is high. But a diversified portfolio across cities or countries spreads exposure, allowing the investor to pivot or rebalance.

Scenario: Attracting Institutional Partners

When a portfolio reaches a scale (multiple properties, centralized reporting, strong cash flows), it becomes attractive to institutional capital such as joint ventures, real estate funds, or institutional equity. The ability to present consolidated financials, growth curve, and scalable operations is compelling to large capital sources.

FAQ

1. How many properties should one aim for to call it a ‘portfolio’?

There’s no fixed counti, it’s more about strategic diversification and scale. Some consider 3+ well-managed properties across different markets as a meaningful portfolio. Others may start with a stabilized anchor asset + one growth play. The quality, risk calibration, and growth potential matter more than sheer count.

2. Can technology replace human management in a real estate portfolio?

No. Technology enhances decision-making, efficiency, and operations, but human expertise remains crucial for negotiation, local market insight, relationships, regulatory navigation, and problem-solving. The best portfolios use tech + human judgment in tandem.

3. How often should a real estate portfolio be rebalanced or assessed?

Typically, an annual or semiannual review is prudent. During those reviews, assess asset performance, debt metrics, market trends, and growth opportunities. Rebalancing may involve selling underperformers, refinancing, repositioning capital, and buying new opportunity assets. In volatile cycles, quarterly check-ins may be warranted.