Portfolio Properties for Sale: Expert Guide, Market Insights, and Real-World Examples

In the ever-evolving real estate market, portfolio properties for sale have emerged as a prime opportunity for institutional and private investors seeking scalable returns. These are not just single units but bundles of multiple properties residential, commercial, or mixed-use sold as a collective investment. This approach offers diversification, stability, and efficiency, making it a preferred choice among seasoned investors.

This article provides a detailed exploration of what portfolio properties for sale are, how they work, their benefits, real-world examples, and how technology is transforming this investment model into a more data-driven and accessible opportunity.

Understanding Portfolio Properties for Sale

Portfolio properties refer to a collection of real estate assets grouped and offered for sale as one consolidated investment package. Rather than purchasing individual properties, investors acquire several at once sometimes across multiple locations or property types.

This strategy is especially common among developers, property management firms, and institutional investors seeking economies of scale. For example, a portfolio might include several apartment complexes, office buildings, or retail centers under one management structure.

Investors benefit from consistent cash flow, portfolio diversification, and a more predictable return on investment since risks are spread across multiple properties.

Why Portfolio Properties for Sale Are Gaining Popularity

The demand for portfolio properties for sale has surged globally due to the growth of large-scale property investors and the rise of real estate funds seeking long-term stability. These investors recognize that managing multiple properties under one portfolio can lead to:

-

Higher operational efficiency through centralized management.

-

Diversified risk exposure, ensuring market downturns in one sector don’t impact the entire investment.

-

Improved capital leverage, since larger portfolios attract favorable financing options.

Additionally, institutional investors like pension funds and private equity firms often target property portfolios to achieve consistent yields with lower volatility compared to equities or bonds.

The Structure of a Real Estate Portfolio

A real estate portfolio can include various asset types depending on the investor’s objectives. Common structures include:

-

Residential Portfolios: Comprising multiple single-family homes, apartment complexes, or rental units.

-

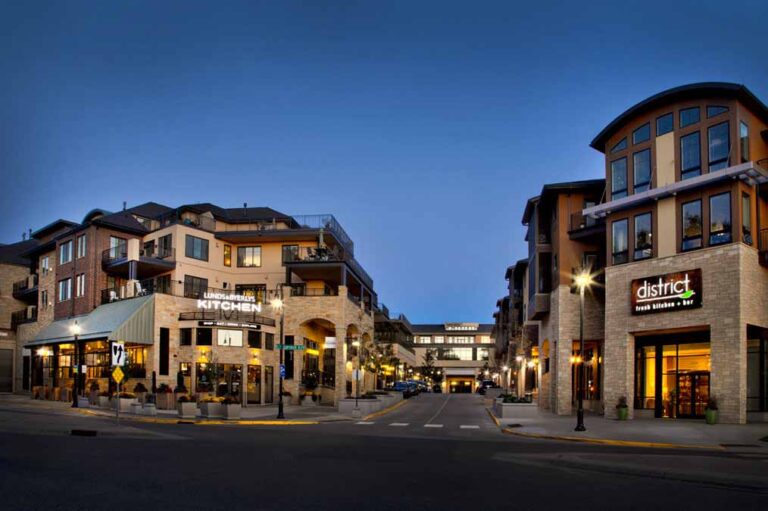

Commercial Portfolios: Featuring office spaces, retail centers, or mixed-use developments.

-

Industrial Portfolios: Consisting of logistics centers, warehouses, and manufacturing properties.

Each structure serves different investment goals, cash flow patterns, and management styles. The choice depends on whether the investor prioritizes income stability, appreciation, or liquidity.

Benefits of Investing in Portfolio Properties

Diversification and Stability

One of the biggest advantages of portfolio investments is risk diversification. When multiple properties are bundled, poor performance in one sector (like retail) may be balanced by strong performance in another (like residential). This reduces exposure to market fluctuations.

Operational Efficiency

Managing several properties under a single management entity or software platform streamlines operations. This includes maintenance, rent collection, and tenant management—resulting in lower costs and increased returns.

Stronger Negotiation Power

Larger portfolios give investors more influence in financing, refinancing, and vendor negotiations. Banks and financial institutions often offer better lending terms for portfolio-scale transactions.

Consistent Income Stream

Having multiple income-generating assets ensures consistent cash flow. This appeals to long-term investors seeking passive income and stability.

How Technology Is Transforming Portfolio Property Management

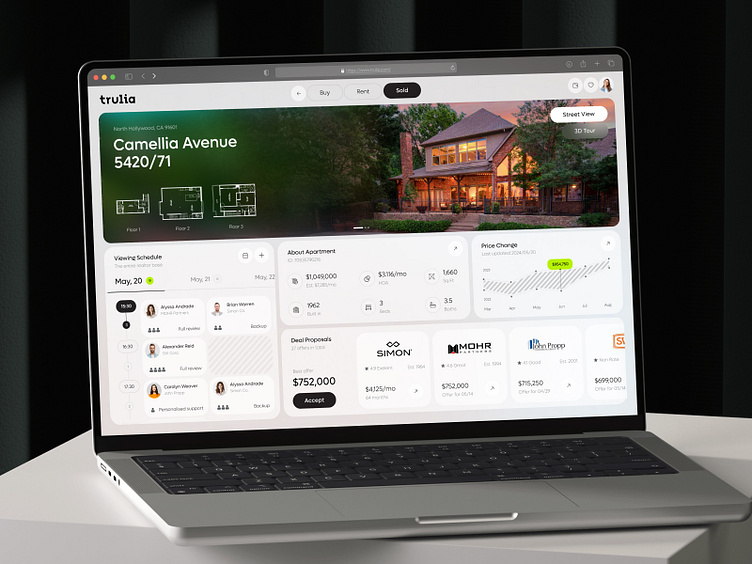

Technology plays a vital role in how portfolio properties are analyzed, acquired, and managed. Modern investors use data analytics, AI, and cloud-based platforms to optimize performance and decision-making.

AI and Predictive Analytics

Artificial intelligence tools can predict rental demand, property appreciation, and market shifts, helping investors make data-driven acquisition decisions. Predictive analytics can identify underperforming assets within a portfolio and suggest optimization strategies.

Digital Twin Technology

Digital twins virtual replicas of physical assets allow investors to simulate operational performance and maintenance requirements before making decisions. This technology minimizes risks and enhances asset value forecasting.

Blockchain and Smart Contracts

Blockchain ensures transparency in property transactions, ownership verification, and lease management. Smart contracts automate rent collection and property transfers, reducing administrative burden and fraud risks.

These technologies collectively enable smarter, faster, and more profitable portfolio management in today’s competitive real estate landscape.

Real-World Examples of Portfolio Properties for Sale

1. Blackstone Group Portfolio

Blackstone, one of the world’s largest real estate investors, has frequently acquired and sold multi-billion-dollar property portfolios across the U.S. and Europe. These portfolios often include office spaces, logistics facilities, and residential complexes.

Their strategy emphasizes long-term value creation through diversification, data-driven acquisitions, and sustainable property development making Blackstone a model of institutional portfolio management success.

2. Greystar Real Estate Partners

Greystar focuses on residential portfolio properties, particularly in the multifamily housing segment. The firm owns and manages thousands of units globally, offering consistent rental income streams.

Their use of advanced management platforms and digital maintenance systems demonstrates how operational efficiency enhances the profitability of large-scale property portfolios.

3. Brookfield Asset Management

Brookfield manages one of the most diverse property portfolios globally, including retail, office, and renewable energy infrastructure. Their balanced portfolio approach and focus on sustainable investments reflect the evolving demands of modern real estate investors.

Brookfield’s case underscores how strategic asset allocation across sectors ensures both financial stability and long-term growth.

Practical Use Cases and Real-Life Applications

Portfolio properties for sale are not limited to institutional investors. Even smaller-scale investors are now forming partnerships or using syndication models to acquire multiple assets simultaneously.

For example, real estate investment groups pool resources to buy residential portfolios in growing suburban markets, benefiting from collective management and shared returns.

In another scenario, commercial investors may acquire several small office complexes under one management entity, spreading costs and reducing vacancy risks.

These examples illustrate how portfolio investments can solve problems such as:

-

Reducing management complexity across multiple locations.

-

Minimizing vacancy risk through tenant diversification.

-

Creating scalable income models that grow with time.

The Future of Portfolio Properties

As real estate markets continue to evolve, portfolio transactions are expected to increase in both volume and sophistication. With globalization, digitalization, and sustainable development trends, portfolio sales will likely integrate ESG (Environmental, Social, Governance) criteria to attract eco-conscious investors.

Additionally, fractional ownership and tokenized property investments are opening new doors for smaller investors to participate in portfolio opportunities previously reserved for institutions.

Frequently Asked Questions (FAQ)

1. What are portfolio properties for sale?

Portfolio properties for sale are groups of multiple real estate assets sold together as a single investment package, often to diversify risk and improve cash flow management.

2. Why are portfolio properties popular among investors?

They offer diversification, consistent income, and operational efficiency. Investors can spread risk across multiple markets or sectors, making returns more stable over time.

3. Can individual investors buy portfolio properties?

Yes. While many portfolios are aimed at institutions, individuals can invest through real estate syndications, partnerships, or REITs that aggregate smaller investor capital into large-scale property acquisitions.