Global Opportunities: The Complete Guide to Overseas Real Estate Investment

Overseas real estate investment refers to the process of purchasing, leasing, or developing property in foreign countries. This form of investment has gained remarkable popularity as investors seek diversification, stability, and high returns in international markets. It provides an opportunity to benefit from economic growth and property appreciation in other parts of the world.

Investing in overseas property is not only about financial gain but also about accessing new lifestyles and business environments. It allows investors to hedge against domestic economic fluctuations, protect their wealth, and take advantage of global trends in tourism, trade, and technology. However, it requires an in-depth understanding of local regulations, taxation, and market conditions.

Why Investors Choose Overseas Real Estate

The appeal of overseas real estate investment lies in its potential for portfolio diversification and higher yield opportunities. Many developed markets have reached maturity, offering limited growth prospects. On the other hand, emerging economies present new frontiers for capital growth and rental income.

Additionally, property ownership abroad can serve as a pathway for residency or citizenship programs in certain countries. This is particularly attractive to high-net-worth individuals seeking lifestyle flexibility and global mobility.

The Role of Technology in Modern Overseas Real Estate Investment

Technology has become a game-changer in the way investors discover, analyze, and manage overseas real estate assets. Digital platforms, artificial intelligence (AI), and blockchain technology have streamlined global transactions and improved transparency.

AI-driven analytics can forecast property performance based on economic indicators, while virtual reality (VR) enables remote viewing of properties thousands of miles away. Blockchain-based smart contracts eliminate the need for intermediaries, reducing fraud risk and transaction time. These innovations empower investors to make data-driven decisions with confidence.

Benefits of Investing in Overseas Real Estate

Investing in overseas property offers multiple benefits that go beyond simple returns. One of the main advantages is diversification; investors can spread risk across markets that react differently to economic cycles. For example, downturns in one region may be offset by growth in another.

Another key benefit is currency appreciation. When an investor purchases property in a strengthening currency market, they can gain from both property appreciation and favorable exchange rate movements. Moreover, countries with booming tourism or technology sectors often see rapid increases in property value, boosting investor gains.

Example Platforms and Investment Opportunities

1. Juwai IQI Global Property Platform

Juwai IQI is a global real estate platform that connects international buyers with properties in Asia, Europe, and North America. It provides localized listings, legal insights, and translation support for international investors.

The platform’s strength lies in its data-driven analytics, which help investors identify undervalued markets. With AI-based trend prediction tools, users can forecast which cities or regions are likely to appreciate over time. This makes Juwai IQI a go-to source for investors looking for emerging markets.

2. CBRE Global Research and Listings

CBRE (Coldwell Banker Richard Ellis) operates one of the most trusted real estate networks in the world. Their overseas property division provides investment listings for both commercial and residential properties.

CBRE’s comprehensive market reports, financial modeling, and valuation tools help investors make informed decisions. It also offers property management and advisory services, which are crucial for long-term overseas investment success.

3. Savills World Research

Savills is a leading international property consultancy offering global investment opportunities. Their research division provides insights into property trends across more than 60 countries.

Savills’ online listings are supported by data analytics that include economic growth forecasts, rental demand indicators, and infrastructure development. This helps investors understand the full picture before committing to an overseas purchase.

4. Knight Frank Global Property Portal

Knight Frank provides access to premium real estate investments worldwide. Its listings cover both residential and commercial sectors, offering in-depth market intelligence and global investment comparisons.

The firm’s technology-driven tools help investors visualize market dynamics through interactive dashboards, offering clarity and confidence when analyzing overseas property portfolios.

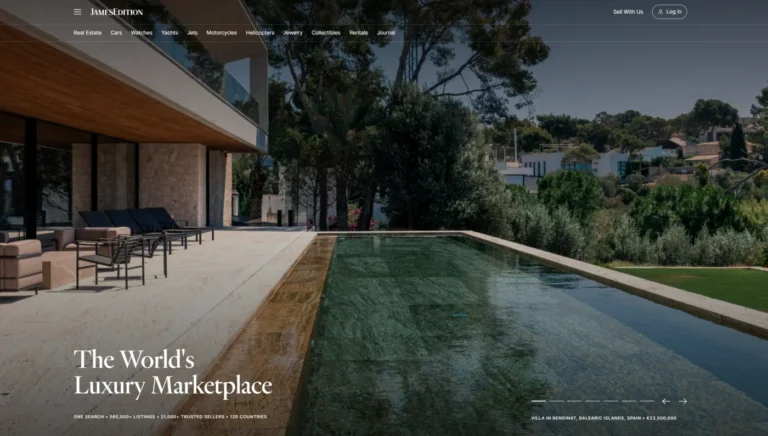

5. Sotheby’s International Realty

Sotheby’s International Realty specializes in luxury properties across major global cities and resort destinations. Each listing features professional photography, architectural highlights, and detailed market analysis.

Its global brand presence ensures credibility and access to high-value properties, making it ideal for investors seeking prestigious and stable assets in international markets.

Practical Use Cases and Real-Life Scenarios

Overseas real estate investment solves several practical challenges faced by investors. For instance, it helps those living in economically unstable countries safeguard their wealth in more secure markets. It also allows expatriates to own homes abroad, reducing rental costs and improving living stability.

Entrepreneurs often invest in overseas properties for business expansion. Commercial spaces in strategic locations like Singapore, Dubai, or London can serve as operational bases or international headquarters. Furthermore, families often purchase overseas homes in education hubs to support their children’s studies, combining investment with practical living needs.

How Technology Enhances Overseas Investment Decisions

Modern investors rely heavily on digital tools for researching and managing their overseas assets. Platforms now integrate real-time market data, allowing users to track property values and rental yields instantly.

Artificial intelligence can detect market patterns and predict future price movements, while blockchain enhances transactional transparency. Investors can now complete property purchases digitally with verified security, avoiding the risks traditionally associated with cross-border deals.

The Future of Overseas Real Estate Investment

The future of overseas property investment will be shaped by technological innovation, sustainability, and global mobility. Investors will increasingly rely on AI-powered insights to identify undervalued regions. Moreover, sustainability will become a critical factor, as environmentally responsible buildings attract more buyers.

Global investors will continue to diversify into emerging markets in Southeast Asia, Africa, and Eastern Europe. These regions are witnessing rapid urbanization, which translates into strong long-term growth potential.

Frequently Asked Questions

1. What is overseas real estate investment?

Overseas real estate investment is the process of buying or developing property in another country to earn returns, diversify assets, or gain residency benefits. It includes residential, commercial, and mixed-use properties.

2. Why is overseas real estate considered a good investment?

It offers investors diversification, exposure to new markets, and protection from domestic economic downturns. Additionally, investors may benefit from higher yields, currency appreciation, and global citizenship options.

3. How has technology improved overseas real estate investing?

Technology enables investors to research, analyze, and transact properties remotely. AI and big data improve decision-making accuracy, while blockchain and VR enhance transparency and convenience in cross-border investments.