The Ultimate Guide to Overseas Property Investment: Insights, Opportunities, and Strategies for Global Investors

Overseas property investment has become a major financial trend as investors seek to diversify their portfolios, access growing markets, and capitalize on favorable real estate conditions abroad. This guide provides comprehensive insights into the benefits, challenges, and strategies of investing in international property, helping you understand what makes this a smart choice in 2025 and beyond.

Understanding Overseas Property Investment

Investing in overseas property means purchasing real estate in a foreign country for profit, lifestyle, or diversification purposes. These investments can range from residential apartments and vacation villas to commercial developments and agricultural land.

The motivations for investing abroad vary. Some investors seek stable rental income in high-demand cities, while others aim for long-term capital appreciation in emerging markets. Many also look for a combination of both.

However, this type of investment comes with unique considerations, including currency fluctuations, local legal systems, and market transparency. Understanding these factors is crucial before making any international move.

Key Benefits of Overseas Property Investment

1. Portfolio Diversification

Overseas property investment provides an effective hedge against domestic market fluctuations. When your home market experiences downturns, your foreign investments may continue to grow, stabilizing your portfolio.

2. Higher Returns in Emerging Markets

Many emerging economies offer strong growth potential and affordable entry prices. Countries in Southeast Asia, Eastern Europe, and parts of Africa often deliver higher yields than mature Western markets.

3. Access to Global Residency Opportunities

Some nations offer residency or citizenship through property investment programs, giving investors lifestyle benefits along with financial gains. Portugal’s Golden Visa and Greece’s Residency by Investment are popular examples.

4. Passive Income and Capital Growth

Renting out international properties in tourist or urban centers can generate consistent passive income. Over time, these properties also appreciate, creating long-term capital growth potential.

Challenges and Risks in Overseas Property Investment

Despite its appeal, investing in foreign real estate requires careful planning and due diligence.

Legal and Regulatory Barriers

Every country has different laws regarding property ownership for foreigners. Some markets, like Thailand, restrict land ownership to citizens, while others, like the UK, offer open access. Understanding legal frameworks before purchasing is critical.

Currency Exchange Volatility

Fluctuations in exchange rates can significantly impact your returns. A strong home currency might make initial investments cheaper, but depreciation can erode future gains.

Property Management and Maintenance

Owning property abroad often means managing it remotely. Investors must factor in property management costs, maintenance, and potential difficulties in finding reliable local agents.

Political and Economic Stability

Changes in government policies or economic downturns in the host country can affect your investment security. Conducting market research on stability and investor protection laws is essential.

Technology’s Role in Overseas Property Investment

Technological advancements have transformed how investors access and manage international real estate.

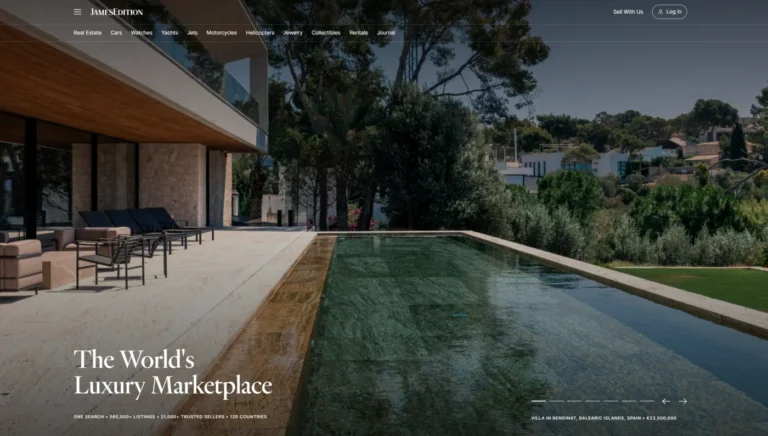

1. Virtual Tours and Digital Marketplaces

With 3D property tours, AI-driven valuation tools, and blockchain-secured listings, investors can now explore and assess properties globally without physical visits. Platforms like Zillow International and Juwai simplify property search and verification.

2. Blockchain and Smart Contracts

Blockchain technology ensures transparency and security in property transactions. Smart contracts allow automatic, tamper-proof transfers of ownership, reducing fraud and intermediary costs.

3. Data Analytics for Market Insights

Investors use data analytics to assess property performance across regions. Tools like PropTech dashboards provide insights into price trends, rental demand, and economic indicators, allowing more informed decision-making.

Real-World Examples of Overseas Property Investment Opportunities

London Luxury Apartments

London remains one of the most attractive global property markets. Despite high prices, it offers stability, strong rental demand, and consistent long-term growth. Prime neighborhoods like Kensington and Canary Wharf attract global investors looking for safety and prestige.

Investors benefit from world-class infrastructure, a robust legal framework, and the city’s global economic role. However, they should also account for taxes like the UK’s stamp duty and maintenance costs.

Bali Vacation Villas

Bali has become a magnet for investors seeking affordable vacation homes with strong rental potential. The booming tourism sector drives high occupancy rates, especially in areas like Canggu and Ubud.

While foreigners cannot directly own land, leasehold structures and partnerships with local entities make ownership possible. The ROI can be significant due to the island’s year-round tourism and growing demand for luxury accommodations.

Lisbon Residential Developments

Portugal’s capital offers one of Europe’s best property investment environments. Through the Golden Visa program, investors gain residency by purchasing qualifying properties.

Lisbon combines affordable prices, a strong rental market, and a growing tech industry demand. The city’s cultural appeal and government incentives make it a top choice for long-term international investors.

Dubai Smart City Projects

Dubai has positioned itself as a global real estate hub. The city’s tax-free environment, futuristic infrastructure, and investor-friendly regulations make it ideal for international buyers.

Areas like Downtown Dubai and Dubai Marina offer luxury living with strong yields. Additionally, innovations like blockchain property registration simplify cross-border transactions.

Bangkok Condominiums

Bangkok’s growing middle class and urbanization trends have fueled demand for modern condominiums. With lower entry prices compared to other Asian capitals, it attracts regional investors seeking rental income and appreciation potential.

Thailand’s property laws allow foreign ownership of condos up to 49% of a building, providing flexibility while ensuring market stability.

Practical Benefits of Investing Overseas

1. Global Financial Growth

Owning property abroad enables participation in international economic growth. As countries develop, property values rise, generating profits beyond domestic opportunities.

2. Lifestyle Advantages

Investors often enjoy dual benefits, financial and personal. Owning a vacation villa or urban apartment abroad provides both passive income and a holiday retreat.

3. Legacy and Long-Term Security

International property serves as a long-term asset that can be passed down through generations. It diversifies family wealth and provides global financial resilience.

Common Use Cases and Real-Life Applications

Retirement Planning

Many retirees buy property in countries with lower living costs and warmer climates. Places like Portugal and Malaysia offer affordable lifestyles and healthcare benefits.

Income Generation

Investors purchase vacation rentals or serviced apartments in tourist hotspots to generate consistent income streams.

Business Expansion

Entrepreneurs acquire properties abroad to establish offices or retail spaces in new markets, leveraging favorable tax and trade conditions.

Frequently Asked Questions (FAQ)

1. Is overseas property investment safe?

Yes, when conducted with thorough research and due diligence. Choose countries with stable political climates, transparent legal systems, and established property rights.

2. How much capital do I need to start investing overseas?

It varies by location. Some markets, like Thailand or Portugal, allow entry with moderate budgets, while cities like London require higher initial capital.

3. What’s the best way to manage property abroad?

Using professional property management services is ideal. Many international agencies specialize in handling maintenance, tenant relations, and rental collections for foreign owners.

Conclusion

Overseas property investment offers immense opportunities for wealth creation, lifestyle enhancement, and financial diversification. While challenges exist, informed investors who leverage technology and global insights can achieve exceptional results in international real estate.