Investors for Construction Business: How to Secure Funding & Build Strategic Partnerships

Construction businesses operate in a capital-intensive, high-risk environment. From land acquisition through permitting, labour, procurement, and construction execution, each phase demands funding, risk management and strategic oversight. For a construction business owner seeking to scale, diversify, or compete for larger contracts, bringing in external investors can offer more than just money: it can provide strategic networks, operational discipline, technology adoption, and growth acceleration.

Having strategic investors in a construction business is not only about the funds; it is about aligning with partners who understand project risk, cycles, cost control, and scope management. Because many construction projects carry long lead times, tight margins, and fluctuation in demand (especially with infrastructure or macro-economic shifts), engaging the right investor can strengthen a business’s resilience and growth trajectory.

Types of Investors Applicable to Construction Businesses

For construction businesses, there are multiple investor types to consider: angel investors or family offices looking at smaller construction firms; venture capital or growth equity investing in construction-technology or innovative delivery firms; private equity funds acquiring mid-sized contractors; and strategic investors such as materials suppliers, real-estate developers or infrastructure funds partnering with construction firms. Each type brings different expectations, involvement, horizon, and expertise.

Selecting the right type of investor means matching your business’s stage, ambitions and risk profile. A small concrete finishing trade may look for family-office backing or growth equity. A construction-technology spin-out may look to venture capital. A mid-sized general contractor may seek private equity to help scale geographically. The nature of construction business cycles, contractual risk and cash-flow profile means investor fit and understanding are especially important in this sector.

How to Prepare Your Construction Business to Attract Investors

Investors look for readiness: a construction business must present strong fundamentals, predictable processes, transparency, and growth potential. One key area is financial clarity: construction firms often operate on project-by-project accounting, which may obscure cash-flow risk and profitability variance. Improving management information, project tracking, and cost control increases appeal.

Another preparation area is risk mitigation and scalability. Investors will examine backlog quality, client concentration, supplier/subcontractor reliability, contract structure (fixed price vs cost plus), geographic diversification, and operational systems. A construction business ready for investment will have refined its processes, documented performance, identified growth opportunities, and mapped out how investor capital will accelerate growth rather than just plug a gap.

Building an Investor-Ready Pitch for Construction Businesses

Crafting an investor pitch for a construction business requires addressing industry‐specific issues: project risk, cost overrun, labour shortage, material inflation, and regulatory changes. Your pitch should clearly explain how your business handles these risks, what differentiates you (management team, niche specialisation, strong clients), and how the investment will be used (new geographic expansion, technology adoption, acquisition of trade companies, vertical integration).

In addition, investors will want to see realistic financials: backlog conversion timelines, margin assumptions, capital expenditure needs, cash-flow projections, and exit or return strategy. Showing how you will scale, improve margins, reduce risk and deliver return on investment is central. Networking, industry events and engaging with investors familiar with construction or infrastructure increases the likelihood of meaningful interest.

Real-World Example Use Cases of Investors in Construction Businesses

Here are three detailed examples illustrating how construction businesses engage investors and the resulting impact.

Growth Capital for Regional Trade Contractor

A regional electrical or mechanical trade contractor has grown steadily but has reached a plateau: limited capital to bid on larger projects, outmoded project management systems, and a lack of geographic reach. An investor (family office or growth equity firm) provides capital to acquire smaller regional contractors, invest in project-management technology, and hire business development staff to win higher-value contracts. The construction business gains scale, improved systems, better margins, and a broader presence. The investor benefits from an enhanced platform, improved profitability, and eventual exit via sale or recapitalisation.

This use case shows how investor involvement can transform a fragmented trade into a competitive regional player. Issues solved include growth constraints, outdated systems, and the inability to bid on larger jobs.

Private Equity Buy-Out of Mid-Sized General Contractor

A mid-sized general contractor with multiple markets aims to expand nationally, improve processes, and access new client segments. A private equity fund performs a buy-out or major equity injection, bringing in operational support (CFO, systems, governance), helping implement digital construction tools (BIM, scheduling software), setting up risk-management frameworks, and targeting higher margins via better procurement and subcontractor management. Over a 5–7 year horizon, the contractor grows revenue, improves profitability, and is sold to a larger strategic acquirer or merges with another platform.

Challenges solved include scaling operations, improving margin discipline, operational transparency, and exit planning. For both business and investor, the transformation delivers value.

Strategic Investor for Construction-Technology Integration

A construction business focused on modular building or advanced materials faces capital constraints but has a strong technology differentiator. A strategic investor, perhaps a large materials supplier or real-estate developer, invests minority equity, provides access to o large project pipeline, supports integration of technology on job-sites, and helps validate the business model at scale. With the investment and strategic link, the construction business moves from pilot stage to full commercial deployment, wins larger contracts, and builds recurring revenue. The investor gains access to innovation, potential vertical integration benefits, and an early stake in growth.

This use case addresses funding gaps, adoption risk, and market access. For the business, the investor’s network and expertise help scale; for the investor, it’s growth and innovation exposure.

Benefits of Engaging Investors for Construction Businesses

Capital Injection Enables Growth & Competitive Advantage

Securing investor funding allows construction firms to pursue growth opportunities they otherwise could not: upgrading technology, acquiring smaller firms, expanding to higher-value projects, hiring specialised talent, and entering new geographies. This accelerates competitive advantage and market positioning.

Operational Improvement & Risk Mitigation

Beyond money, investors often bring operational expertise, governance discipline, financial oversight, and technology adoption. For construction businesses, where risk (cost rollover, labour, supply chain) is substantial, having investor-backed systems reduces uncertain outcomes, increases transparency, and enhances credibility with clients and lenders.

Enhanced Credibility and Better Contract Access

Having an investor on board signals to clients, subcontractors and banks that the business is supported, governed, and aligned for growth. This can open doors to larger contracts, improved supplier terms and better financing options.

Diversified Growth Path and Exit Options

With investor backing, a construction business can plan its path: scaling, consolidating smaller firms, building platforms, and eventually seeking exit or recapitalisation with stronger value. For founders, it offers an avenue to realise value; for investors, it provides a return horizon.

Technology Adoption & Future-Readiness

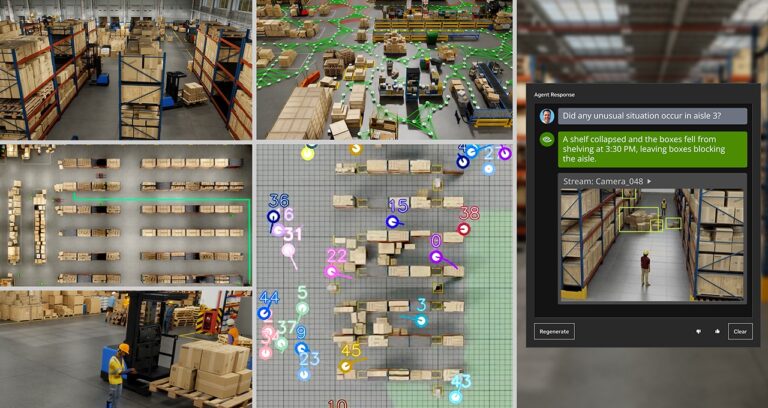

Investor involvement often brings focus on technology adoption (digital job-site tools, modular construction, automation) that can differentiate the business and yield improved productivity, better margins and sustainable growth. Given that construction is historically lagging in productivity, this can be a major benefit.

Practical Use Cases: What Problems Can Investors for Construction Businesses Solve?

Use Case 1: Cash-Flow Crunch and Bid Limitations

Problem: A construction firm has a steady workload but limited working capital, forcing it to decline larger projects or rely on slow receivables, resulting in bidding on lower-value jobs.

>Solution: An investor injects growth capital, enabling the firm to handle larger contracts, improve liquidity, commit to subcontractors earlier, and secure better materials pricing.

Why it’s useful: The business expands its addressable market, improves margins, and enhances competitive positioning.

Use Case 2: Limited Scale and Competitive Disadvantage

Problem: The construction business is restricted to a local region, lacks systems, bidding capacity, and cannot compete with national players for large projects.

>Solution: Investor funds support the acquisition of peer firms, the implementation of centralised project-management systems, the hiring of a business development team, and entry into larger markets.

Why it’s useful: The business transitions from regional niche to larger player; investor gains platform scale and exit potential.

Use Case 3: Technology & Operational Inefficiency

Problem: A construction business struggles with cost overruns, labour inefficiency, outdated processes, and the inability to compete on performance.

>Solution: With investor backing, the business invests in digital tools, modular construction capability, training for supervisors, and data-driven performance metrics.

>Why it’s useful: The business boosts productivity, reduces risk, improves margin, positions for high-value contracts, and becomes more attractive to future partners or acquirers.

Key Challenges and What to Avoid When Seeking Investors

Securing investors for a construction business is beneficial, but there are pitfalls. Firstly, investors unfamiliar with construction may underestimate execution risk: cost overruns, supply chain disruptions, regulatory changes, and labour shortages. Failure to demonstrate strong processes, project-by-project visibility, and risk mitigation can lead to investor reluctance.

Secondly, construction is cyclical. Projects depend on economic cycles, interest rates, government infrastructure spending, and real-estate markets. An investor may misjudge timing and expose the business to downturns. Thirdly, giving up too much control or incompatible partner goals can harm business culture, strategic direction or operational flexibility. Finally, technology investments or growth plans backed by investor funds must be executed well; poor execution can erode value and investor trust.

Summary and Strategic Takeaways

Securing investors for your construction business is not just about raising funds; it’s about aligning with strategic partners who understand the construction ecosystem, co-build operational strength, and support scalable growth. Key takeaways:

-

Prepare your business with transparency, strong systems, a growth story and risk-control measures.

-

Match the right type of investor to your stage, ambition and business model.

-

Use investor funds to accelerate growth (geographic expansion, acquisitions, tech adoption), improve operations, and build value.

-

Leverage investor credibility to access larger contracts, better supply terms and stronger financial position.

-

Be aware of construction-specific risks (cycles, cost inflation, labour, regulation) and ensure your investor partner is aligned and understands the sector.

-

Plan for exit or long-term growth investors typically want clarity on return horizon, value creation and exit options.

With solid preparation and the right partner, your construction business can scale rapidly while offering investors access to strong, tangible growth opportunities.

Frequently Asked Questions

1. What kinds of investors are most appropriate for a construction business?

>>>>Investors suitable for construction businesses include growth equity firms (for scaling trade contractors), private equity funds (for larger contractors wanting expansion), strategic investors (materials suppliers, developers), and investors focusing on technology or innovation (for construction tech-enabled businesses). The right fit depends on your business’s stage, goals, and capital-structure needs.

2. What should I focus on when preparing to attract investors to my construction business?

>>>>Focus on strong financial reporting (project-by-project visibility), backlog and client quality, contract structure and risk profile (fixed vs cost plus), systems and technology readiness, growth strategy (acquisitions, new markets, tech), and clarity on how investor capital will be used to deliver value and return. Investors need comfort around execution risk and operations.

3. How does bringing in an investor help a construction business beyond just capital?

Beyond capital, a good investor can bring operational oversight, strategic networks (clients, suppliers, subcontractors), access to larger contracts, systems uplift (technology, process), improved credibility, better financing/leverage, and help with exit or long-term strategy. Especially in construction, where risk is high and margins are tight, these value-adds can make a significant difference.