Smart Ways to Invest in Construction Projects: Strategies, Risks, and Real-World Insights

Investing in Construction Projects has emerged as one of the most effective strategies for building long-term wealth and achieving portfolio diversification. From residential housing and commercial developments to major infrastructure projects, construction investments provide strong potential for sustainable growth. To succeed, investors must understand the dynamics behind each project, the factors influencing profitability, and the best ways to manage associated risks.

At its foundation, investing in construction projects means allocating capital to the creation, expansion, or renovation of physical assets such as residential complexes, office buildings, bridges, or highways. Investors can participate through direct property ownership, joint ventures, real estate investment funds, or construction bonds, each offering different risk profiles and return potentials.

Types of Construction Investments

Direct Project Funding

When you invest in construction projects through direct investment, it means funding specific developments by purchasing land, initiating a building project, or partnering with professional contractors and developers. This approach offers the potential for higher returns compared to indirect methods, but it also comes with increased risks. To succeed, investors must perform thorough due diligence, including verifying permits, assessing contractor credibility, and analyzing local market dem, and before committing capital.

Real Estate Investment Trusts (REITs)

For those looking to invest in construction projects with lower entry barriers, construction-oriented Real Estate Investment Trusts (REITs) present an attractive option. These funds pool investor capital to finance and manage income-generating real estate assets, including residential complexes, shopping malls, and industrial developments. By investing in REITs, individuals can gain exposure to the construction and property market with added benefits of liquidity, diversification, and professional management, though the returns are often more moderate compared to direct construction investments.

Construction Bonds

Another way to invest in construction projects is through construction bonds, which are ideal for investors seeking more stable and predictable returns. These bonds are used to finance large-scale infrastructure developments such as highways, bridges, and public facilities, offering fixed interest payments over a specified period. Typically issued by governments or major corporations, construction bonds are considered lower-risk investments because they are often backed by public or institutional funding, providing investors with greater security while still contributing to essential development initiatives.

Joint Ventures and Private Equity Funds

High-net-worth investors often join construction joint ventures or private equity funds to back large developments. These partnerships combine resources, expertise, and capital to pursue complex projects, balancing risk and reward through shared responsibility.

Benefits of Investing in Construction Projects

Construction investments are not just about profit; they contribute to economic development and infrastructure growth. Here are several notable benefits:

- Capital Appreciation: As properties develop and markets expand, investors benefit from significant appreciation over time.

- Steady Cash Flow: Rental income from completed properties provides consistent returns.

- Portfolio Diversification: Construction investments balance the risk from volatile markets.

- Inflation Hedge: Property values often rise alongside inflation, preserving purchasing power.

Technological Advancements in Construction Investment

Modern construction investment leverages technology to minimize risk and optimize efficiency. Digital tools like Building Information Modeling (BIM), AI-based project analytics, and drone mapping enhance decision-making, allowing investors to track progress and control costs.

Blockchain technology is also reshaping the investment process. Through smart contracts, investors can ensure transparent transactions and timely payments. Additionally, data analytics helps forecast market trends, helping investors make informed project choices.

Real-World Examples of Successful Construction Investments

Hudson Yards, New York City

Hudson Yards is one of the largest private construction projects in U.S. history. Backed by private equity investors and real estate funds, this $25 billion development transformed Manhattan’s West Side. Investors benefited from rising property values and long-term commercial leases.

Dubai Creek Harbor, UAE

Dubai Creek Harbor showcases how visionary construction projects attract global investors. Developed by Emaar Properties, the project integrates smart city technology and sustainable design, providing a lucrative opportunity for international investors seeking long-term growth.

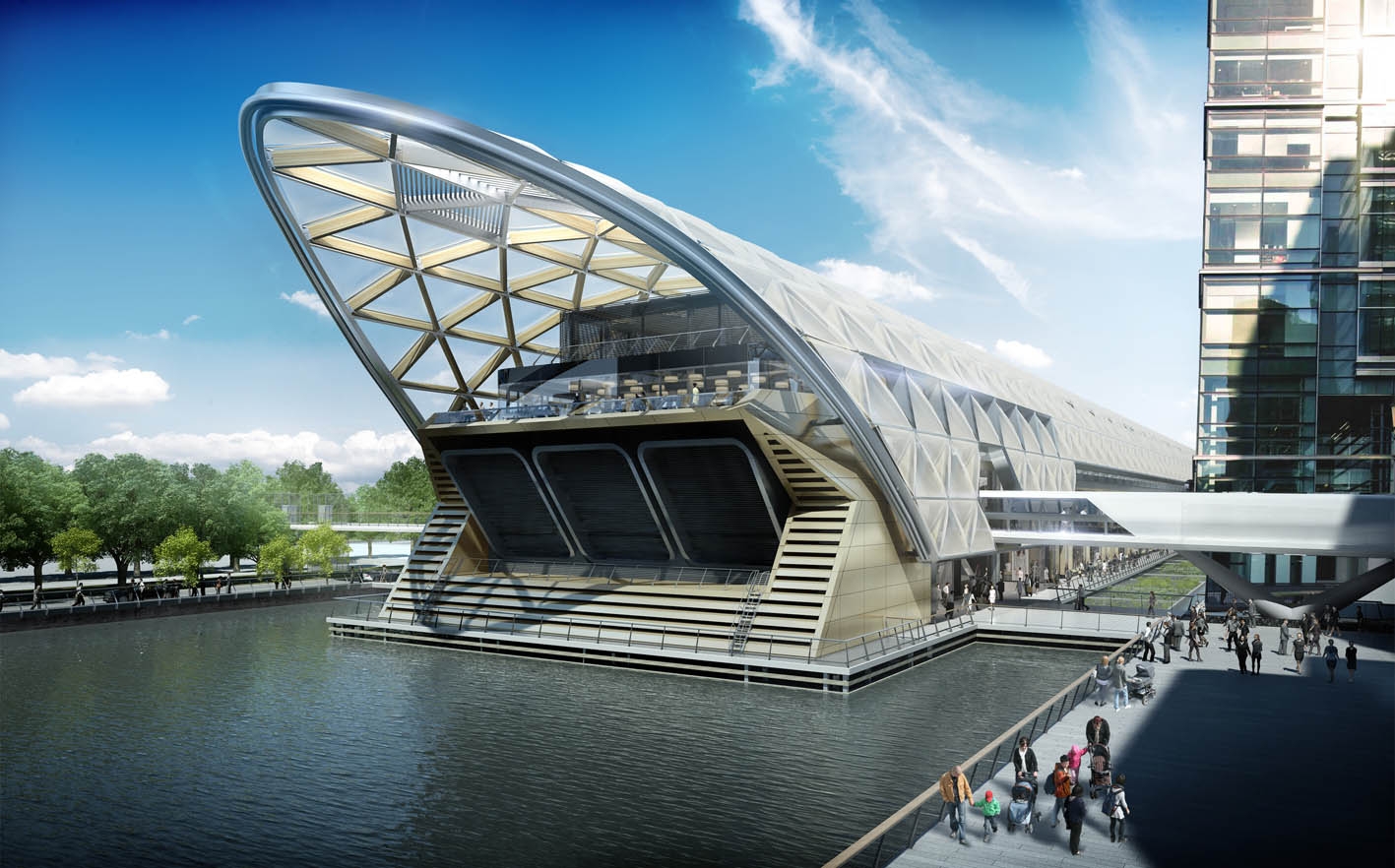

Crossrail Project, London

This major UK infrastructure project demonstrates how public-private partnerships (PPP) can create stable investment returns. Funded by a combination of government bonds and private investments, Crossrail expanded London’s transport capacity while offering predictable yields for institutional investors.

Marina Bay Sands, Singapore

A prime example of integrated resort development, Marina Bay Sands attracted billions in foreign investment and became a symbol of successful construction financing. Investors gained from tourism-driven revenue and regional property appreciation.

Risk Management in Construction Investment

While construction projects promise high returns, they also come with challenges such as cost overruns, delays, and regulatory issues. Effective risk management is crucial:

- Feasibility Studies: Evaluate market demand, project costs, and expected ROI before committing.

- Diversification: Spread investments across multiple projects or regions to minimize exposure.

- Legal Safeguards: Ensure all contracts, permits, and insurance coverage are in place.

- Professional Oversight: Collaborate with experienced developers and financial advisors.

Use Cases of Investing in Construction Projects

Investing in construction projects solves several real-world problems:

- Housing Shortages: Investors play a role in funding affordable housing developments.

- Urban Infrastructure Gaps: Investments in bridges, roads, and public spaces improve city connectivity.

- Sustainability Goals: Green building projects contribute to reducing carbon emissions.

- Job Creation: Construction investments stimulate employment and boost local economies.

In emerging markets, construction investment often becomes a key driver of development. For example, renewable energy projects, eco-friendly housing, and smart city infrastructure attract socially responsible investors seeking both financial and environmental impact.

Practical Benefits of Construction Project Investments

- Long-Term Wealth Creation: Construction projects provide tangible assets with appreciating value.

- Control Over Asset: Direct investors can influence design, leasing, and sale strategies.

- Community Development: Many investors align their portfolios with projects that enhance social welfare.

Conclusion

Investing in construction projects requires strategic thinking, risk awareness, and market insight. With proper planning and diversification, this sector offers unmatched potential for sustainable financial growth. Leveraging modern technology and choosing projects with long-term societal impact can lead to significant rewards.

FAQs

1. What is the best way to start investing in construction projects?

Start by understanding the types of investments available: direct funding, REITs, or bonds, then assess your capital, risk tolerance, and market knowledge. Consulting with a financial advisor or joining a construction investment fund can help minimize risks.

2. How risky is investing in construction projects?

Construction investments carry moderate to high risk due to potential delays, cost overruns, and market fluctuations. However, proper research, diversification, and professional management can significantly reduce these risks.

3. Are construction project investments suitable for beginners?

Yes, but beginners should start with lower-risk options like REITs or construction bonds before engaging in direct project investments. Gaining industry knowledge first helps ensure more informed and profitable decisions.