Exploring International Rental Properties: A Complete Guide for Global Investors

International rental properties refer to residential or commercial real estate assets located outside an investor’s home country that generate rental income. These properties have become an integral part of global investment strategies as investors seek opportunities beyond domestic markets. The rise of digital real estate platforms and cross-border financing has made international rental investment more accessible and transparent than ever.

Investing in international rental properties allows investors to benefit from global economic trends, urbanization, and rising demand for rentals in key destinations. Whether it’s short-term vacation rentals in Europe or long-term housing in Asia, these assets offer a blend of stability, cash flow, and capital appreciation.

Why Investors Are Turning to International Rental Properties

Global investors are increasingly diversifying their portfolios by acquiring rental properties overseas. The primary motivation is income diversification; having rental income streams from multiple regions reduces dependency on a single economy. Additionally, property markets in emerging countries often provide higher yields compared to mature markets.

Another factor is lifestyle flexibility. Investors can combine business with pleasure by owning rental properties in locations where they frequently travel or plan to retire. This creates both financial and personal advantages.

The Role of Technology in the International Rental Market

Technology has revolutionized how investors discover, evaluate, and manage rental properties across borders. Advanced data analytics, AI-driven valuation models, and property management software simplify the process of overseas ownership.

Virtual reality (VR) tours allow investors to view and assess rental properties without physical presence, while blockchain ensures transaction transparency. Furthermore, platforms equipped with predictive analytics can estimate future rental yields and occupancy rates, enabling smarter investment decisions.

Benefits of Investing in International Rental Properties

One of the major benefits of owning international rental properties is steady income generation. Rental demand in global hubs such as London, Dubai, and Singapore remains high due to population mobility, tourism, and limited local housing supply.

Another benefit is long-term asset appreciation. Well-located properties in developing or high-demand regions often experience consistent growth in value. Additionally, owning international rentals can offer currency advantages and protection against inflation in the investor’s home country.

Leading Platforms for International Rental Properties

1. Airbnb Global Rentals

Airbnb is one of the most influential platforms in the international rental property industry. It allows property owners to list and rent out accommodations worldwide, from apartments in Tokyo to villas in Spain. The platform facilitates cross-border rentals with secure payment systems and localized customer support.

Airbnb’s extensive user base provides reliable occupancy rates, especially in tourist-driven markets. For investors, Airbnb serves as a digital gateway to short-term rental income with flexible management options.

2. Booking.com Apartments and Vacation Homes

Booking.com is another powerhouse in the global rental sector. It lists millions of apartments, vacation homes, and serviced residences around the world. For investors, the platform offers exposure to an international audience, ensuring consistent booking rates.

What sets Booking.com apart is its data-driven insights into traveler behavior. Property owners can access real-time analytics to adjust pricing and availability for optimal returns, making it ideal for data-oriented investors.

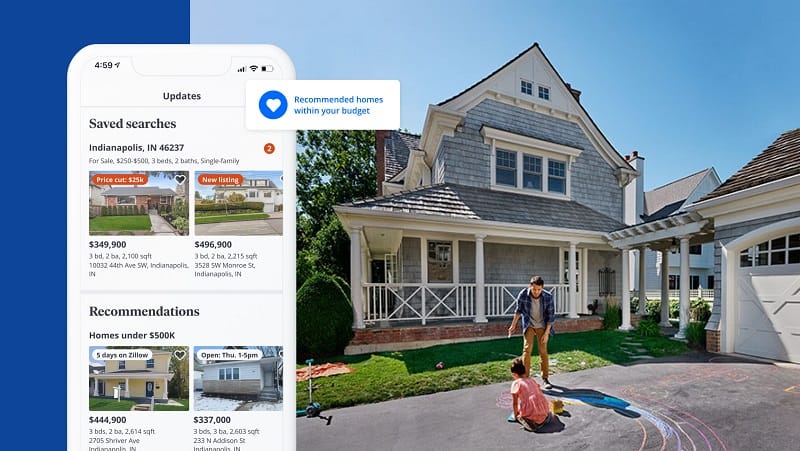

3. Zillow International Rentals

Zillow’s international branch provides listings for long-term rentals and investment properties across various regions. Its comprehensive market data helps investors analyze price trends, rental yields, and neighborhood profiles.

Zillow’s technological advantage lies in its AI-based property evaluation tools. These tools estimate property values and predict rental growth, empowering investors with accurate and actionable information.

4. Rightmove Overseas Rentals

Rightmove Overseas offers rental listings across Europe, the United States, and Asia-Pacific. It caters to both short-term and long-term rental markets, allowing investors to reach global tenants easily.

The platform’s regional filters and market insights assist investors in identifying high-demand areas. This helps landlords tailor their offerings to meet local tenant needs while maximizing returns.

5. Nestpick Global Furnished Rentals

Nestpick specializes in furnished mid- to long-term rentals. It aggregates listings from multiple global platforms, simplifying the search process for international tenants and landlords.

Nestpick’s emphasis on furnished housing appeals to expatriates, remote workers, and student segments who represent strong and consistent rental demand in major cities like Berlin, New York, and Singapore.

How International Rental Properties Benefit Investors

International rental investments provide multiple strategic advantages. They help investors hedge against economic downturns in their home countries by diversifying income sources. Rental yields from high-demand regions can serve as a stable revenue stream even during global uncertainty.

Additionally, investing abroad may offer tax incentives and residency benefits depending on the jurisdiction. Some countries encourage foreign real estate investment by offering reduced property taxes or citizenship through investment programs.

Real-Life Use Cases and Practical Applications

International rental properties solve key challenges for both investors and tenants. For remote professionals, global rentals enable flexible living arrangements. Investors, on the other hand, benefit from steady cash flow and long-term appreciation in regions experiencing urban growth.

For example, an investor owning apartments in Lisbon can cater to the booming digital nomad community, while another renting condos in Bangkok can capitalize on the city’s affordable cost of living and tourism-driven demand. These use cases illustrate how global rental properties align with modern mobility and lifestyle trends.

Technology Enhancing Property Management and Investment Decisions

Managing international rental properties can be complex, but technology makes it simpler and more efficient. Property management platforms integrate AI tools that automate rent collection, maintenance requests, and tenant screening.

Big data enables predictive maintenance, ensuring properties remain in good condition and reducing vacancy periods. Moreover, smart home technologies increase property value by improving energy efficiency and security factors highly attractive to international tenants.

The Future of International Rental Investments

The future of international rental properties is intertwined with global mobility, sustainability, and digital transformation. With the rise of remote work, more people are seeking flexible housing across continents, fueling rental demand in cosmopolitan cities.

Sustainability will also shape investment strategies. Properties that meet green building standards and energy efficiency certifications are expected to outperform traditional rentals in value and occupancy rates.

Frequently Asked Questions

1. What are international rental properties?

International rental properties are real estate assets located outside one’s home country that are leased to generate rental income. They include residential homes, apartments, villas, and commercial spaces.

2. Why should investors consider international rental properties?

They offer income diversification, potential for higher yields, and long-term appreciation. International rentals also serve as a hedge against domestic economic fluctuations and currency risks.

3. How is technology improving the global rental property market?

Technology simplifies cross-border transactions, enhances transparency through blockchain, and improves decision-making through AI-driven analytics and virtual property tours. This allows investors to manage properties remotely with confidence.