Construction Private Equity: A Strategic Guide to Investing in the Built-Environment

Construction private equity refers to the application of private equity (PE) investment strategies within the construction sector, meaning PE funds or firms invest capital, acquire or recapitalize construction companies (contractors, materials suppliers, construction-technology firms), or fund construction-oriented projects, to achieve value creation, growth, and eventual exit.

This matters because the construction industry is massive (buildings, infrastructure, industrial) and has historically been fragmented, under-optimized, and technology-light. Private equity’s involvement brings not only capital, but operational improvements, structural change, roll-ups, and professionalization. That means for business owners in construction and for investors seeking alternative growth sectors, construction PE offers attractive opportunities but also distinct risks (cycles, cost overruns, execution risk).

As infrastructure demands rise globally and construction becomes more technology-driven, the role of PE in this space is accelerating. For stakeholders in the built environment, understanding how construction private equity works is increasingly important.

How Construction Private Equity Deals Are Structured

When a private equity firm targets a construction company, the structure can vary: a majority buy-out, a growth equity investment, a recapitalization, or a platform roll-up strategy. For instance, a typical majority buy-out involves the PE firm acquiring control while allowing the founder to stay on during a transition period.

Another structure is growth capital: the construction business may remain founder-owned, but takes on PE investment to fund expansion, technology adoption, or geographic growth. A recapitalization may allow the owner to realize some liquidity while staying involved. Understanding the exact structure is critical because it affects governance, exit timeline, control, and risk allocation.

In the construction sector, especially, PE deals also frequently involve roll-up strategies: acquiring a “platform” contractor or materials supplier and then acquiring smaller firms in adjacent geographies or niches to build scale. Many PE firms are buying specialty trade businesses and combining them into regional or national players.

Key deal structure considerations include: debt levels (leverage), management-equity alignment, earn-outs for sellers, operational improvement programs, governance enhancements, technology implementation, and exit planning (sale, IPO, strategic merger). For a construction business, being clear on how the PE firm plans value creation is essential.

Real-World Example Use Cases of Construction Private Equity

Below are three detailed use cases illustrating how construction private equity plays out in practice, each with a distinct focus and value drivers.

Specialty Contractor Platform Acquisition

A private equity firm identifies a mid-sized specialty trade contractor (e.g., HVAC, mechanical services) with regional presence, steady backlog, and a loyal client base. The PE firm acquires a controlling stake (“platform”). Then over the next 3-5 years, the firm executes a roll-up strategy: acquiring smaller contractors in adjacent geographical markets, centralizing back-office functions (HR, systems, procurement), introducing standardized project-management software, and leveraging increased scale to negotiate better subcontractor and materials deals. This creates synergies, higher margins, and value appreciation. Finally, the platform is sold to a strategic buyer or merged with a larger group.

This example shows how PE invests in operational scale, not just capital. The initial target must have operational discipline, a management team, clean financials, and scalability. Owners benefit via liquidity and growth, while investors capture value via transformation and exit.

Materials Manufacturer Transformation

A construction private equity firm invests in a building-materials manufacturer (e.g., prefabricated wall panels) that supplies contractors and developers. The business is stable but under-invested in automation, systems, and market expansion. The PE firm provides capital to modernize equipment, implement automation, optimize supply-chain logistics, expand into new regions, and possibly bolt-on smaller complementary manufacturers. Over a 5–7 year period, the company grows revenue, improves margin, and then is sold to a strategic purchaser (larger materials conglomerate) or via IPO.

In this case, the value-creation driver is less dependent on project execution risk (which is high for general contractors) and more on manufacturing operations, supply-chain scale, and margins. For investors, materials firms in the construction ecosystem can be attractive targets.

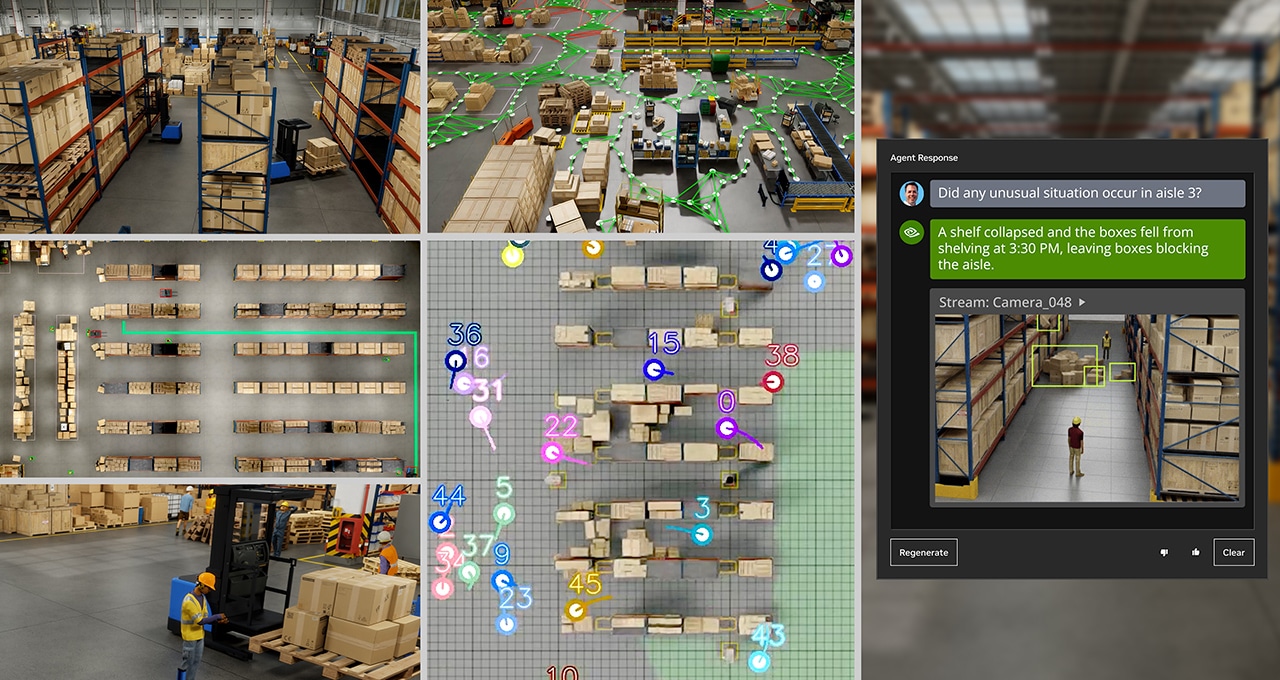

Construction-Technology Firm Investment

Another use-case: a PE firm (or growth-equity fund) invests in a construction-technology (ConTech) company, perhaps specializing in modular off-site construction, job-site robotics, or digital job-site analytics. The PE firm partners with the company, provides growth capital, brings in industry networks (contractors, developers), helps scale commercial deployment, and positions the company for consolidation or exit (sale to a major construction firm/supplier).

Although this example lies slightly outside traditional contractor investment, it is highly relevant because PE firms in construction increasingly recognize that technology adoption offers value creation pathways that bring not just capital but knowledge of new trends, such as reducing carbon emissions and digitalization to construction firms.

Benefits of Construction Private Equity: Why Business Owners and Investors Engage

Capital & Growth Enablement

For construction companies, a key benefit of PE is access to sizeable capital that can fund growth, acquisitions, technology, equipment, geographic expansion, or larger contracts. PE firms provide the large amounts of capital needed to fund construction companies’ projects, buy advanced equipment, and improve operations.

Operational Improvement & Professionalization

Beyond funding, PE firms bring operational expertise: improved governance, financial controls, project-management systems, standardized workflows, procurement leverage, and talent development. This transition from “owner-operator” to “institutionalized business” often improves margins, risk management, and attractiveness to buyers.

Scale, Consolidation & Exit Value

In a fragmented sector like construction, consolidation via PE can unlock economies of scale, centralize functions, improve bargaining power, and create regional or national players. For investors, increased scale raises exit value. For business owners, a partnership with PE can crystallize value and enable succession or liquidity.

Technology Adoption & Future-Proofing

The construction industry has historically been slow in productivity improvements and technology uptake. PE firms recognize this gap and support their portfolio companies to adopt digital tools, modular methods, robotics, IoT, and sustainability practices. This positions portfolio companies for future growth and helps de-risk them.

Risk Mitigation & Financial Resilience

Construction businesses face large risks (cost overrun, labor shortages, procurement issues, and cyclicality). PE firms bring financial discipline, better processes, and oversight. When a construction company becomes PE-backed, it may be better prepared for downturns and able to access resources for operational resilience.

Practical Use-Cases: What Problems Does Construction Private Equity Solve?

Use Case 1: Owner-Operator Contractor Lacking Growth Path

Problem: A regional general contracting business is founder-led, growth has stagnated, management is overloaded, and bidding for larger projects is difficult due to a lack of internal systems and capital.

Solution: A PE firm partners to acquire a majority stake; capital is injected, a professional management team is brought in, systems are standardized, acquisitions of adjacent contractors are made, and procurement savings are realized.

Why it’s useful: The business now transitions to institutional scale, can compete for larger bids, expands geographic reach, improves profitability, and offers the founder liquidity. For the investor, the platform offers the opportunity to scale and exit at a higher multiple.

Use Case 2: Fragmented Trade Contractor Industry with Low Margins

Problem: Many small trade contractors (e.g., electrical, plumbing) operate independently with thin margins, minimal systems, a difficult bidding environment, and limited scalability.

Solution: A PE firm selects one as a platform, then acquires several smaller peers in multiple regions, consolidates functions (finance, HR, procurement), introduces project-management technology, group purchasing, and leverages scale.

Why it’s useful: This solves the problem of fragmentation, improves margin via synergies, reduces risk via diversification, and positions the combined entity for sale to a strategic acquirer.

Use Case 3: Materials Supplier with Stagnant Growth & Capital Constraints

Problem: A building-materials manufacturer is regionally strong but lacks capital to automate and expand, facing competition from larger national players. Growth is limited, and generational transfer is looming.

Solution: A PE firm invests growth equity, funds equipment upgrades, expands into new geographies, integrates the acquisition of smaller material suppliers and logistics firms, upgrades systems, and sales channels.

Why it’s useful: The business unlocks growth, improves margin, builds scale, and exits at a higher value. The investor captures value via operational improvement and exit.

Key Challenges and What to Watch Out For

While construction private equity offers significant potential, the sector also presents unique challenges:

-

Cyclicality & Market Risk: Construction demand fluctuates with economic cycles, interest rates, infrastructure spend, regulation, and material and labor cost shocks. Even PE-backed firms must navigate downturns.

-

Execution Risk: Construction projects are prone to delays, cost overruns, labor shortages, material inflation, and permitting issues. Investing in a contractor with weak risk management invites failure.

-

Operational Complexity: Many construction firms are owner-dependent, lack systems, and have informal processes. PE must assess the ability to professionalize the business; otherwise, value creation is hard.

-

Integration/Consolidation Risk: Roll-up strategies face risks of cultural mismatch, management capacity, integration of disparate systems, and geographic dispersion.

-

Exit Timing & Valuation Pressure: PE funds have finite horizons (typically 5–8 years); if market conditions turn or growth stalls, the exit value may be compromised.

-

Technology Adoption Risks: Although technology offers upside, adoption in construction can be slower than expected; investment in tech must be managed and monetized.

Business owners and investors alike must perform rigorous due diligence, understand the sector context, align interests clearly, and build realistic value-creation plans.

Summary and Strategic Investor/Owner Takeaways

Construction private equity represents a dynamic intersection of capital, construction operations, and value creation. For investors, it offers access to large, growing sectors of the built environment; for business owners, it offers growth capital, operational improvement, and exit pathways.

Key takeaways:

-

Understand the business model: contractor, supplier, technolo,gy, or platform.

-

Ensure the target has strong financials, backlog, management, scalability, a nd operational systems.

-

Structure deal appropriately: equity vs buy-out, alignment of management, roll-up potential, value-creation plan.

-

Leverage operational improvement and technology adoption as value drivers.

-

Be aware of sector-specific risks: cycles, execution, integration, and financing.

Using real-world examples (specialty contractor roll-up, materials supplier transformation, ConTech investment) helps illustrate the strategy and pathways.

For owners, partnering with the right PE firm can accelerate growth, professionalize the business, and create liquidity. For investors, construction PE offers attractive returns if executed well.

Construction private equity is not a passive play; it demands rigorous execution, alignment of interest, and strategic thinking. But with the right combination of capital, operational enhancement, and market opportunity, it can be a powerful way to unlock value in the built environment.

Frequently Asked Questions

1. What kinds of construction companies are most attractive to private equity?

PE firms tend to target construction companies with steady cash flows, strong backlog, good management teams, scalability, and operational discipline. They favor businesses that are not overly owner-dependent, have a clear niche or geographic growth potential, and can benefit from consolidation or technology adoption.

2. How does private equity add value beyond providing capital to construction firms?

Beyond capital, PE firms bring operational governance, professional management systems, consolidation strategies (roll-ups), procurement leverage, technology implementation, and exit planning. They assist in transforming an owner-operated business into a scalable enterprise.

3. What is the typical exit strategy for construction private equity investments?

Common exit strategies include the sale of the business to a strategic acquirer, merger with a larger platform, recapitalization, or, in some cases,s IPO. The timing is often 5–8 years post-investment, depending on growth trajectory, market conditions, and value creation. It is essential to align exit planning early in the investment process.