Building Wealth Through Smart Investing: The Complete Guide to Buy Property Portfolio

Buying a property portfolio is one of the most powerful ways to generate consistent income and long-term wealth through real estate. Unlike purchasing a single property, a portfolio strategy involves managing multiple properties with diverse locations, price ranges, and returns designed to minimize risk and maximize financial stability.

This guide explores how to buy a property portfolio, the technology and tools that help investors manage it effectively, and examples of successful real-world portfolios that demonstrate the potential of this investment strategy.

What Is a Property Portfolio?

A property portfolio is a collection of real estate investments owned by an individual, company, or group. These assets may include residential, commercial, and rental properties located in different areas or countries.

Building a portfolio is about diversification and scalability. Instead of relying on a single property for income, investors can spread their risk across various markets. When one asset underperforms, others may still generate strong returns helping stabilize overall profitability.

Why Buy a Property Portfolio Instead of a Single Property

Buying a property portfolio offers several advantages compared to owning one property. The most significant benefit is income diversification multiple rental streams create a more stable financial foundation. Additionally, it allows investors to benefit from:

-

Capital growth potential across different property types

-

Tax efficiency through strategic ownership structures

-

Stronger negotiating power when dealing with lenders and agents

With a well-planned strategy, property portfolios can evolve into scalable assets that deliver both short-term cash flow and long-term appreciation.

Key Factors to Consider Before You Buy a Property Portfolio

Before diving into portfolio ownership, it’s essential to plan strategically. Every decision from financing to location affects long-term success.

Investment Goals

Clarify your goals: are you focused on monthly rental income, property appreciation, or a mix of both? Defining this early ensures that your acquisitions align with your overall financial objectives.

Market Research

Analyze property markets thoroughly. Look for areas with strong population growth, employment opportunities, and infrastructure development. These factors contribute to stable demand and rising property values.

Financial Planning and Leverage

Smart investors use leverage responsibly. Mortgage financing can accelerate portfolio growth, but over-leveraging increases risk. Always maintain healthy loan-to-value ratios and sufficient liquidity for emergencies.

The Role of Technology in Managing Property Portfolios

Technology has revolutionized real estate portfolio management. From data-driven market analysis to automated rent collection systems, digital tools make managing multiple assets more efficient.

Property Management Platforms

Platforms like Buildium and AppFolio help automate rent payments, maintenance requests, and tenant communication. They also provide real-time analytics to help investors track performance and expenses.

Real Estate Analytics Tools

Software like Mashvisor and Roofstock Cloudhouse offer predictive insights into market trends, rental yields, and occupancy rates helping investors make informed acquisition decisions based on solid data.

Cloud Accounting and Reporting

Cloud-based systems like QuickBooks for Real Estate simplify financial management, ensuring transparency and accuracy across multiple properties.

Real-World Examples of Property Portfolio Strategies

To better understand how to buy and manage property portfolios successfully, let’s look at some real-world examples from different investment approaches.

Blackstone Real Estate Portfolio

Blackstone is one of the world’s largest property investors, holding a diverse portfolio of residential, commercial, and logistics assets across global markets.

Blackstone’s approach focuses on long-term appreciation and institutional-grade diversification. By targeting both stable income assets and growth markets, they’ve maintained resilience even through economic cycles. Their model demonstrates how strategic asset allocation and risk management create sustainable value over time.

REIT Portfolios (Real Estate Investment Trusts)

Publicly traded REITs like Prologis and Simon Property Group represent managed portfolios of income-generating real estate.

Investors can buy shares of these portfolios to gain exposure to real estate without direct ownership responsibilities. These REITs are known for stable dividend payouts and liquidity, offering a great entry point for investors who want to benefit from large-scale portfolio management strategies.

Private Property Portfolios in Emerging Markets

Private investors often build portfolios in developing countries where real estate prices are lower but appreciation potential is high.

For example, portfolios in Southeast Asia or Eastern Europe have shown impressive growth due to urban expansion and rising middle-class demand. These investors leverage early market entry and rental yield optimization to outperform more mature property markets.

Institutional Housing Portfolios

Companies like Greystar Real Estate Partners focus on large-scale residential portfolios. Their model emphasizes operational efficiency, tenant satisfaction, and data-backed asset management.

This approach showcases how professional systems and digital tools can make large property portfolios both manageable and profitable.

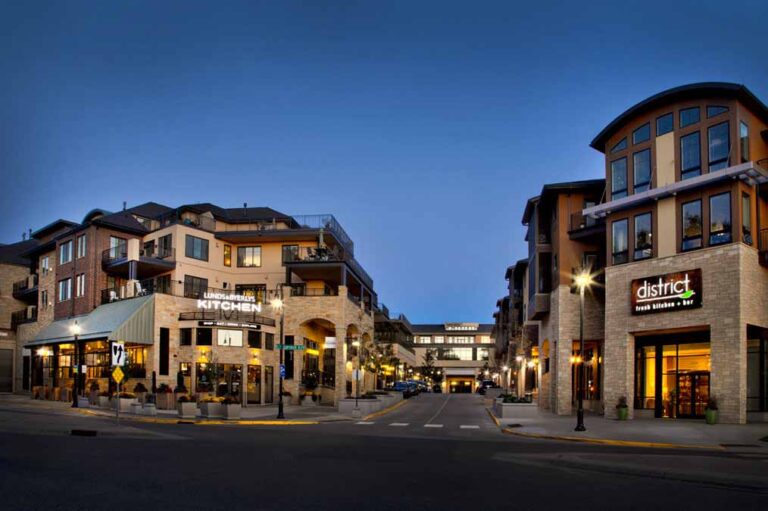

Mixed-Use Property Portfolios

Some investors diversify further by owning a mix of commercial, residential, and retail spaces. This creates multiple revenue streams and reduces dependency on one sector.

Mixed-use portfolios also benefit from cross-utilization of property spaces such as integrating retail on the ground floor and apartments above, maximizing rental yield per square meter.

Benefits of Owning a Property Portfolio

Buying a property portfolio offers long-term financial and operational advantages that individual property owners rarely achieve.

Financial Stability

Multiple properties mean multiple income streams. Even if one property remains vacant, others can continue to generate rent ensuring cash flow stability.

Appreciation Potential

A portfolio enables investors to spread assets across markets. When one region’s prices plateau, another may rise, allowing consistent overall growth.

Tax Optimization

Owning multiple properties allows for better use of tax deductions, depreciation, and offsetting strategies that improve net returns.

Common Challenges and How to Overcome Them

Every investment strategy comes with its own risks. Property portfolios require significant management and capital discipline.

Financing Complexity

Securing loans for multiple properties can be challenging. Maintaining a strong credit profile and stable income history helps in obtaining better financing terms.

Market Volatility

Diversification reduces risk, but investors should still monitor economic cycles and adjust holdings accordingly. Using analytics tools helps anticipate downturns early.

Use Cases: When Buying a Property Portfolio Makes Sense

A property portfolio is particularly useful for:

-

Investors seeking consistent passive income through rentals

-

Entrepreneurs building generational wealth

-

Corporations diversifying their investment base

-

Retirement planners looking for inflation-resistant income sources

For example, an investor could buy three residential properties in different cities to balance high-rent urban units with low-maintenance suburban houses. Over time, capital growth from one can fund expansion of another creating a self-sustaining investment cycle.

FAQs

1. How much capital do I need to start a property portfolio?

It varies widely by region, but many investors begin with one or two properties financed through mortgages. The key is leveraging existing equity smartly to scale up gradually.

2. Is it risky to own multiple properties?

It can be if poorly managed. However, diversification across markets and property types significantly reduces risk compared to single-property ownership.

3. How do I manage a large property portfolio efficiently?

Using professional property managers and modern digital tools such as Buildium or AppFolio can automate most administrative tasks and financial reporting, making management simpler and more transparent.