Construction Investment Companies: Comprehensive Guide for Investors and Industry Professionals

A construction investment company refers to an organization that provides capital, takes equity or debt positions, or otherwise finances and invests in construction-oriented businesses, developments, infrastructure, or building companies. These firms may act as private equity funds, venture capital firms focused on construction technology (“ConTech”), family offices, asset managers specializing in the built environment, or dedicated development & investment firms that also execute construction projects.

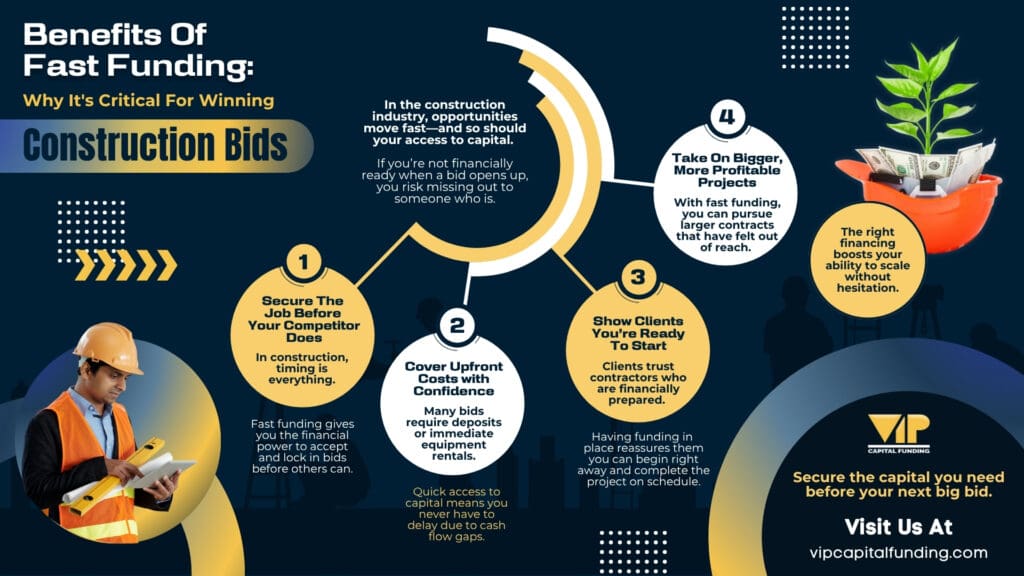

The significance of these companies lies in the scale, risk profile, and potential returns of construction and infrastructure. The construction sector is inherently capital-intensive, often requiring substantial upfront resources for land acquisition, permitting, materials, labor, and equipment. Construction investment companies help to fill this financing gap, provide operational and strategic expertise, and share the risk. Moreover, as global demand for infrastructure, urbanization, and modern commercial/residential buildings grows, the role of such investment firms becomes increasingly pivotal.

Within the broader investment ecosystem, construction investment companies serve a dual role: They are conduits of capital to the built-environment space, and they bring operational, governance, and strategic value to construction enterprises. The selection of the keyword “construction investment companies” as the top informational focus makes sense because stakeholders, whether investors, entrepreneurs, developers, or construction business owners, increasingly seek to understand the structure, strategies, and benefits of these types of entities.

How Construction Investment Companies Operate

Construction investment companies typically operate through a set of defined strategies: they identify target companies or projects, deploy capital (equity, debt, B, Tt, or hybrid), add value via oversight, expertise, or operational improvements, and eventually aim for an exit (sale or refinancing). The entire lifecycle from investment to value creation to exit is carefully managed, given the inherent construction risks (delays, cost overruns, regulatory issulaborbour problems, supply chain disruptions).

Sourcing and due diligence

These firms begin by sourcing opportunities: a construction company seeking growth capital, a real-estate developer needing build-to-rent infrastructure, a ConTech start-up that aims to modernize jobsite operations, or an infrastructure project in need of equity/Mezzanine financing. Due diligence is thorough: assessing market demand, construction risk, cost structure, contractor credentials, regulatory compliance, and potential supply-chain disruptions.

Value creation and operational oversight

Once invested, the investment company often provides more than just money. They may bring strategic oversight, help implement best practices (financial controls, project management, technology adoption), strengthen governance, assist in scaling operations, or enter new geographies.

Exit strategies

Exit may take the form of selling the company to another strategic buyer, IPO, recapitalization, or refinancing the asset or company once improved. The aim is value appreciation and realizing returns for investors. Because construction and development projects can have long horizons, the investment timeline is typically multi-year (5–10 years or more), and performance depends on execution as much as market conditions.

Risk and return dynamics

Construction investment companies face unique risks: cost overruns, regulatory delays, macroeconomic cycles (housing, infrastructure), labor/material shortages, inflation of input costs, and geographic/geopolitical exposure. But the potential returns are also significant: capturing growth urbanization, infrastructure repurposing, technological transformation in construction, and rising demand for modern built assets.

Real-World Use Cases of Construction Investment Companies

Here are three detailed, real-world examples of how construction investment companies or investment approaches in the construction sector are applied. Each illustrates a different type of investment scenario and how the firm adds value.

Private Equity Firm Investing in Construction Companies

Consider a private equity firm that targets mid-sized construction companies (general contractors or specialty trade firms). The firm performs due diligence and then acquires a majority stake in the contractor. After acquisition, the PE firm implements stronger financial controls, introduces improved project-management technology, streamlines overhead, and guides the company into new markets (e.g., expanding from local operations to national). Over a 5-7 year hold period, the company grows revenue and margin, perhaps through strategic acquisitions of smaller trade firms, boosting value. Eventually, the PE firm exits via sale to a larger strategic construction group or via public market listing.

Venture Capital / ConTech Investment in Construction Technology Start-Ups

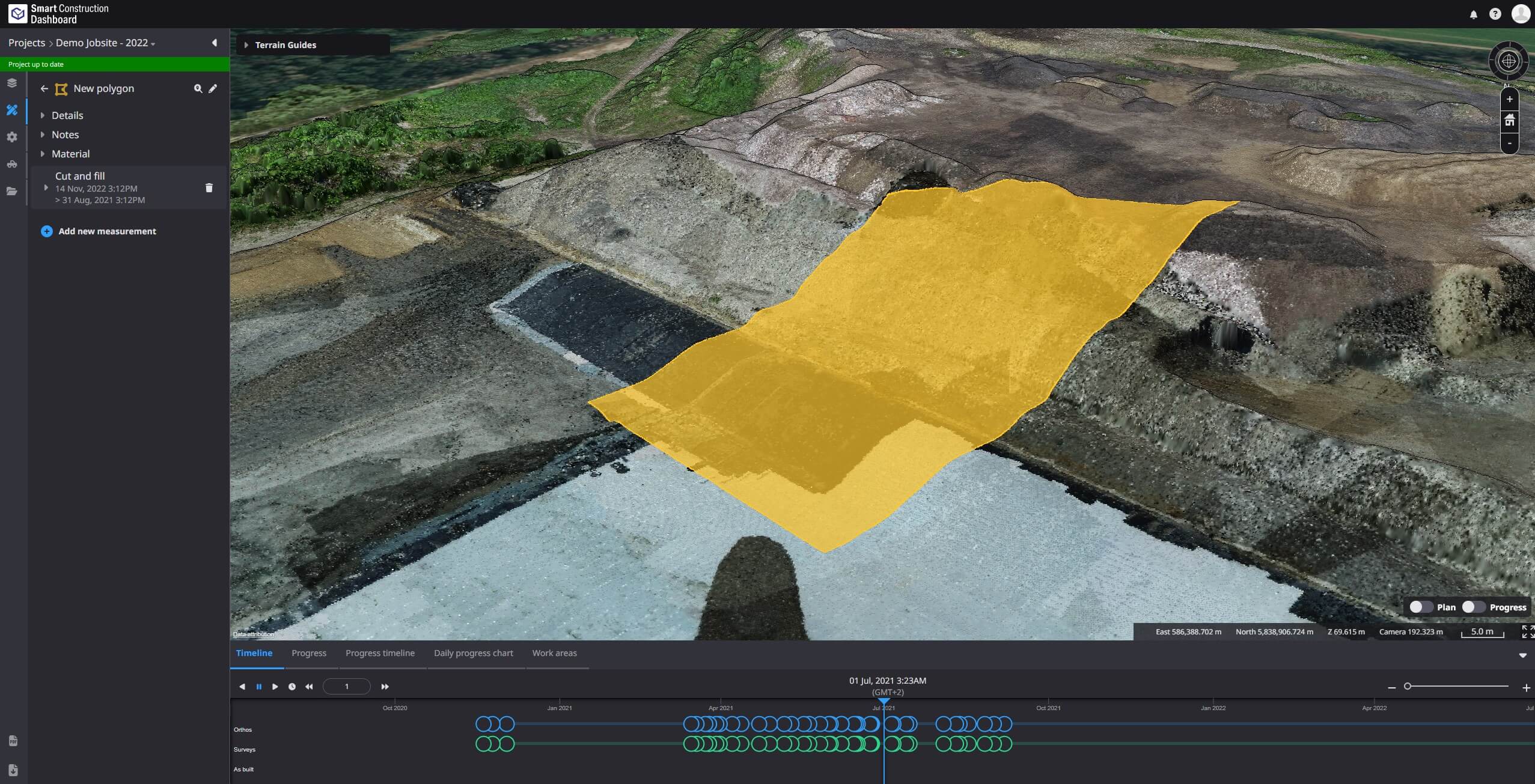

Another use case: an investment company that focuses on construction technology (ConTech). Here, the firm invests in a startup that develops robotics for jobsite automation or software that optimizes building logistics. The construction investment company supplies not only the capital but also connects the startup to pilot sites (contractor partners), assists with industry-specific go-to-market strategy, and helps with integration into actual construction workflows.

Development/Infrastructure Investment Company Executing Construction Projects and Holding Assets

A third scenario: a development-oriented investment company that both invests in and executes major construction/infrastructure projects and then holds the assets for cash flow or sells them when complete. For example, a firm builds a mixed-use development (residential + commercial) in a growth region, manages construction risk, leases the building post-completion, and either holds it as a long-term asset or sells it.

Benefits of Engaging with Construction Investment Companies

Access to Capital and Expertise

One of the major benefits is access to specialized capital tailored to construction and built-environment risk. Construction investment companies bring both the capital and the sector expertise to evaluate and manage this risk.

Enhanced Operational Efficiency and Value Creation

Because many construction investment companies bring operational know-how, they can deliver improvements beyond capital injection. They may implement systems for project monitoring, adopt technologies that reduce waste or accelerate timelines, improve procurement processes, and transform management practices.

Diversified Risk Exposure and Portfolio Building

From an investor standpoint, construction investment companies provide an opportunity to diversify into an asset class that behaves differently from equities or pure real estate.

Greater Exit Potential and Long-Term Value

These companies often plan structured strategies for exit sale, IPO, recapitalization, or asset sale, increasing liquidity potential and strategic flexibility.

Innovation and Technology Adoption

Construction investment companies often drive modernization through modular construction, sustainable materials, or advanced project management technology.

Practical Use Cases: Solving Problems with Construction Investment Companies

Use Case 1: Scaling a Construction Trade Business Facing Growth Constraints

A regional contractor struggling with capital and management limitations can partner with a construction investment company to gain capital, modern systems, and access to new markets.

Use Case 2: Modernizing Construction Operations via Tech Investment

A contractor suffering from inefficiency and delays can benefit from investments in construction tech like AI-based monitoring, modular building, or IoT integration.

Use Case 3: Financing a Large-Scale Development Project

A developer facing financing and execution challenges can work with an investment company providing equity, risk management, and governance oversight to ensure project completion.

Key Challenges and What to Look Out For

Construction investment companies face challenges such as:

-

Execution Risk: Delays, overruns, and regulatory issues.

-

Market Cycles: Sensitivity to economic downturns and interest rates.

-

Oversupply: Risk of excess capacity in developed markets.

-

Quality and Compliance: Maintaining standards to avoid future losses.

-

Exit Uncertainty: Market conditions may affect sale timing or valuation.

Summary and Strategic Takeaways

Key takeaways:

-

The keyword “construction investment companies” highlights a vital segment of built-environment financing.

-

These firms combine finance, operational know-how, and strategic exits.

-

Benefits include access to capital, expertise, efficiency, diversification, and innovation.

-

Challenges must be managed via experience, due diligence, and market understanding.

Frequently Asked Questions

Q1: What types of investments do construction investment companies typically make?

They invest through equity or debt in construction firms, fund large development or infrastructure projects, back ConTech start-ups, or hold built assets like commercial and mixed-use properties.

Q2: How can a construction investment company add value beyond just providing capital?

By offering operational expertise, networks, technology implementation, and structured exit strategies that enhance project execution and returns.

Q3: What should I look for when choosing a construction investment company to invest with or partner with?

Look for a proven track record, construction domain expertise, a clear exit strategy, transparency, governance, and strong risk management processes.