Investing in Construction Projects: A Strategic Guide for Long-Term Growth

Construction represents one of the most tangible forms of investment: physical assets, development timelines, structural risk, and reward. When you choose to invest in construction projects, you commit capital not only to bricks and mortar but to processes, timelines, regulations, and execution. For investors seeking portfolio diversification and long-term growth beyond traditional stocks and bonds, construction project investment offers a powerful opportunity, ty provided you understand how it works, what drives success, and how to manage inherent risks.

In this gu, you will find in-depth insights into how to invest in construction projects, the main approaches, the role of emerging technologies, detailed real-world examples, benefits and use-cases, and the key questions you should ask before committing capital.

What it means to invest in construction projects

Investing in construction projects means committing resources, capital, and time, expertise to the creation, expansion, or renovation of physical structures. These may include residential developments, commercial buildings, infrastructure such as bridges or highways, or mixed-use complexes. Rather than simply buying an existing asset, this form of investment is foundational: the asset is built or improved, and value is generated in the development process.

This kind of investment differs from simple real-estate ownership in one key way: you are involved before the building is completed. That phase carries a higher risk (permits, cost overruns, completion risk) but also a higher potential reward, because you are participating in value creation.

Key pathways for investing in construction projects

There are several major pathways through which investors can invest in construction projects. Understanding the differences is crucial to selecting the right route based on risk tolerance, capital, timeline, and involvement level.

Direct project investment

In direct investment, you might purchase land or join with a developer to build a residential or commercial development. You participate in the development process from the ground up: funding land acquisition, construction, permitting, and ultimately leasing or sale. The upside is high: you capture value at multiple stages (land appreciation, build margin, eventual sale or rental). But the risks are significant: delays, cost escalations, zoning changes, and market softening can erode returns.

Financing via debt or bonds

Another pathway is to invest in construction via debt instruments or bonds that finance projects rather than equity ownership. These provide a more fixed-income style return but still participate in the construction cycle. They tend to carry lower upside but also somewhat lower risk, since the investment is more passive and repaid over time.

Equity funds, joint ventures, and pooled vehicles

For many investors, participating in a pooled vehicle (such as a real-estate development fund or joint venture) offers access to construction projects without managing them directly. These vehicles raise capital from many investors, allocate to multiple projects, and manage execution. This route offers diversification and professional oversight, but often with fees and less control.

Infrastructure and public-private projects

Some construction investment focuses on large infrastructure projects (roads, bridges, utilities,s), often in partnership with governments. These may have longer timelines, but often more stable cash flows and strong social or economic backing. The global infrastructure landscape is being reshaped by urbanization, technology, and investment demand.

Real-World Examples of Investing in Construction Projects

Example 1: Urban mixed-use residential development

A real estate developer identifies a high-growth suburb and purchases land for a 200-unit mixed-use development (residential + retail). Investors commit capital for land acquisition and construction. The project timeline spans 24 months, with completion, leasing, and eventual sale or long-term hold. Because of strong local housing demand and limited supply, the development achieves above-average rental rates and appreciation. The investor benefits from value creation (land uplift, construction margin, leasing income) and multiple exit strategies.

Key lessons: choosing the right market, controlling build cost and timeline, and aligning development design to demand are critical success factors. Risk arises if housing demand softens, interest rates rise, or construction delays occur.

Example 2: Large-scale infrastructure investment via public-private partnership

Consider a partnership between a private development firm, a government agency, and institutional investors to build a toll bridge. Investors fund the construction in exchange for long-term cash flow from tolls. The public-private model distributes risks between the public entity (regulatory, permitting) and the private investor (construction, financing). Given the essential nature of infrastructure, the project may enjoy stable demand even in economic downturns.

This example shows how construction-project investing is not just residential real estate; it can be large-scale, long-term, and anchored by societal needs.

Example 3: Residential new-home construction development

New home construction offers attractive returns when demand outpaces supply. An investor funds a builder to develop 100 homes, aimed at first-time buyers in a growing metro area. Because the homes are new, with modern amenities, they command premium pricing. After construction, the homes may be sold or rented. The value creation is tied to the construction process itself—land cost, build speed, and design efficiency.

The relevant insight is: investing in the construction phase (rather than buying completed property) gives access to earlier value creation, but also demands strong execution.

The Role of Technology in Construction Project Investing

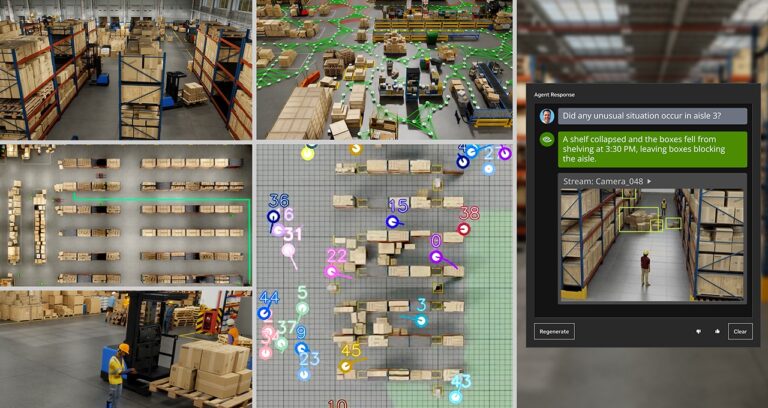

Technology is increasingly transforming the construction-investment landscape, reducing risk, improving transparency, and enhancing project execution. Applying advanced tools helps investors and developers manage cost, schedule, and quality.

For example, Building Information Modeling (BIM) and 3D modeling reduce the likelihood of design changes after construction starts, which is a major cost driver. Meanwhile, drone site monitoring, IoT sensors, automated equipment, and data analytics provide real-time insight into progress and cost overruns. Research shows that blockchain-enabled fund-management systems enhance transparency and traceability in construction-project investing.

By adopting these technologies, investors gain better oversight, can identify issues sooner, and reduce execution risk. For instance, a construction fund using smart-contract payments tied to progress monitoring can ensure that funds are released only when milestones are achieved.

Benefits of Investing in Construction Projects

Investing in construction projects offers several tangible advantages for the right investor:

-

High upside potential: Because you participate in the creation of new assets, the value can be significantly higher than simply buying existing properties.

-

Portfolio diversification: Construction-project investing provides an alternative asset class less correlated with stock market performance and adds tangible-asset exposure.

-

Inflation hedge: Construction investments often benefit when material costs and property values rise, helping preserve purchasing power.

-

Control and customization: Especially in direct investment or joint ventures, you can influence design, use, financing structure, and exit strategy, aligning the investment with your goals.

-

Contribution to infrastructure and growth: Some construction projects serve essential needs (housing shortage, urban expansion, infrastructure build-out), which provide societal contribution and potential regulatory support.

Practical Use Cases: What Problems Investing in Construction Solves & Why It Matters

Use Case 1: Addressing Housing Shortages

In many growing cities, housing supply lags population growth. Investors who fund construction projects help meet this supply gap, whether it’s new residential developments, high-density housing, or affordable units. This not only offers a commercial return but also helps solve real-world housing access problems.

Use Case 2: Infrastructure and Urban Renewal Needs

Urban infrastructure (roads, bridges, public transit) is aging or insufficient in many regions. Investing in construction projects via infrastructure builds meets a societal need while offering long-term cash flows or capital appreciation. Such projects may also benefit from government support or incentives, reducing risk.

Use Case 3: Capturing Value from Emerging Markets & Markets Undergoing Transition

In emerging economies or growth regions, construction-project investment allows investors to participate in physical capital growth, urbanization, and economic transformation. These growth-oriented investments provide access to markets where infrastructure and housing demand are rapidly expanding.

Use Case 4: Transitioning Portfolio Strategy

For an investor with heavy exposure to stocks or bonds, adding a construction-project investment can provide a non-traditional asset class, balancing market cycles and providing returns when other sectors are weak. For instance, when equity risk is high, a well-managed construction fund may deliver.

Risks and Key Considerations When Investing in Construction Projects

While the benefits are compelling, construction-project investing is not without risk. Key considerations include:

-

Project execution risk: Delays, cost overruns, contractor defaults, and permitting issues can materially reduce returns.

-

Market timing and cycle risk: Construction demand is cyclical when macroeconomic conditions weaken, demand may drop, land values may stagnate, a nd financing may become harder.

-

Capital lock-up and liquidity risk: Many construction projects are not liquid investments you may not be able to exit quickly.

-

Regulatory and environmental risk: Zoning, land-use, environmental compliancelaborur regulations, and political shifts can affect timelines and costs.

-

Cost inflation and supply-chain risk: Construction materials and labor can face dramatic price swings, squeezing margins.

-

Partner or developer risk: If the developer or contractor lacks experience or financial strength, investment risk rises.

Thorough due diligence, selecting experienced partners, stress-testing assumptions, a nd building in contingency are essential mitigants.

Conclusion

Investing in construction projects offers a powerful pathway to wealth creation, offering access to value creation from ground-up development and infrastructure build-out. For investors who understand the risks, choose the right structures, and leverage modern technology, construction-project investment can diversify a portfolio, capture inflation hedge dynamics, and align with societal growth trends.

However, success depends on execution, market timing, partner quality, and oversight. By understanding how the construction lifecycle works, how to evaluate opportunities, and how to use technology to manage risk, you can participate in this sector more effectively.

FAQs

1. What is the minimum capital needed to invest in construction projects?

It varies widely based on approach. Direct project investment in real estate requires substantial capital (land, construction financing, and financing costs). Pooled vehicles, equity funds, or debt instruments might require lower entry capital. Always ask for transparent cost breakdowns and minimums from the investment vehicle.

2. How long does a construction project investment typically take to realize returns?

It depends on project size and structure. Residential developments might be completed in 12–36 months, and infrastructure may span 5–10+ years. Debt-financing structures may return sooner but with lower upside. Investors should plan their horizon accordingly and consider lock-in periods.

3. How can technology reduce risk when investing in construction projects?

Technology such as BIM, drones, data analytics, IoT monitoring, blockchain fund management, and smart contracts enhances transparency, monitors execution, automates payments based on progress, and helps detect cost or schedule issues early. This leads to better oversight, fewer surprises, and improved investment outcomes.