Understanding Home Builder Stocks ETF: A Comprehensive Guide for Smart Investors

Investing in home builder stocks ETF has become increasingly popular as the housing and construction markets continue to play a vital role in economic development. For investors seeking diversified exposure to companies involved in home construction, building materials, and real estate development, these ETFs provide a balanced and strategic approach. This article explores what home builder stocks ETFs are, how they work, and how they can fit into a broader investment portfolio.

What Are Home Builder Stocks ETFs?

Home Builder Stocks ETFs (Exchange-Traded Funds) are financial instruments that track the performance of a basket of companies within the homebuilding sector. These include residential construction firms, suppliers of building materials, and home improvement companies. By investing in an ETF, investors gain access to a diverse range of companies without needing to buy individual stocks.

Unlike direct stock investments, ETFs offer liquidity, transparency, and diversification. They trade on major exchanges like regular stocks, allowing investors to buy or sell shares throughout the trading day. This makes them a convenient way to invest in the construction and housing industry’s overall performance.

Why Investors Choose Home Builder Stocks ETFs

Investors are drawn to home builder stocks and ETFs for several reasons. First, these ETFs allow for diversification within a single investment, reducing the risks associated with holding individual company shares. Second, they offer exposure to one of the most cyclical yet potentially rewarding sectors, housing. As demand for new homes grows due to population increases and urbanization, home builder companies tend to see rising revenues and profits.

Additionally, these ETFs allow investors to benefit from trends in real estate development, infrastructure spending, and government housing incentives. They can be particularly appealing during periods of low interest rates or strong housing market performance.

Key Components of Home Builder Stocks ETFs

Most home builder ETFs include major publicly traded construction companies and suppliers. The portfolio typically consists of firms engaged in residential home construction, building materials, and related services. Some ETFs also include companies involved in home furnishings or construction financing.

A well-structured ETF will include large-cap, mid-cap, and small-cap companies, ensuring balanced exposure across the sector. The weighting of these companies is often based on market capitalization or index tracking, depending on the ETF provider.

Top Examples of Home Builder Stocks ETFs

iShares U.S. Home Construction ETF (ITB)

The iShares U.S. Home Construction ETF (ITB) is one of the most well-known ETFs in this category. It tracks the Dow Jones U.S. Select Home Construction Index, which includes leading homebuilders such as D.R. Horton, Lennar Corporation, and PulteGroup. ITB provides concentrated exposure to the housing construction segment and reflects overall trends in residential development.

This ETF tends to perform well during housing booms when consumer demand for new homes is high. However, it may also be sensitive to interest rate changes that impact mortgage affordability.

SPDR S&P Homebuilders ETF (XHB)

Another popular choice is the SPDR S&P Homebuilders ETF (XHB), which tracks the S&P Homebuilders Select Industry Index. Unlike ITB, XHB takes an equal-weight approach, offering broader exposure not only to homebuilders but also to companies involved in home improvement and building materials, such as Home Depot and Lowe’s.

This ETF appeals to investors who prefer balanced exposure across multiple subsectors within the housing market, reducing dependence on large homebuilding firms alone.

Invesco Dynamic Building & Construction ETF (PKB)

The Invesco Dynamic Building & Construction ETF (PKB) offers a different approach by selecting companies based on fundamental and risk-based criteria rather than purely market capitalization. Its portfolio includes firms involved in residential, commercial, and industrial construction, making it a more diversified play on the broader building sector.

This ETF can be attractive for investors seeking active exposure to construction-related opportunities beyond residential housing.

Benefits of Investing in Home Builder Stocks ETFs

Home builder ETFs provide several advantages for investors seeking targeted exposure to the housing and construction market. First, they reduce the need to research individual companies since the ETF already includes a diversified selection of industry leaders. This diversification helps mitigate company-specific risks while maintaining growth potential.

Second, ETFs are cost-effective compared to actively managed funds, as they often have lower expense ratios. They also provide liquidity since they can be traded easily on stock exchanges. Additionally, home builder ETFs can serve as an inflation hedge, as construction and real estate often benefit from rising material costs and property values.

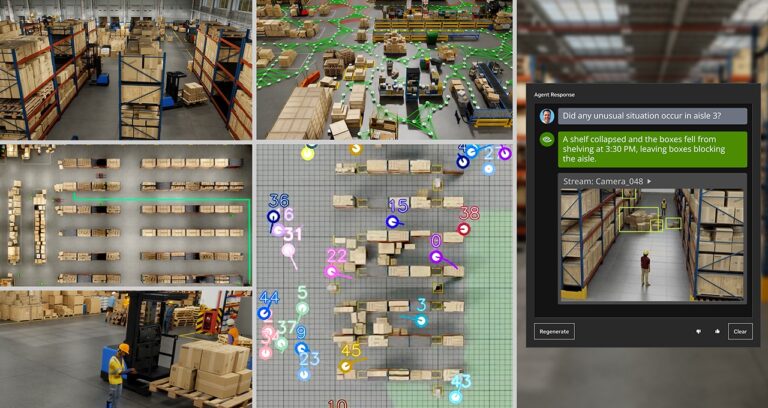

Technological Advancements in the Home Building Sector

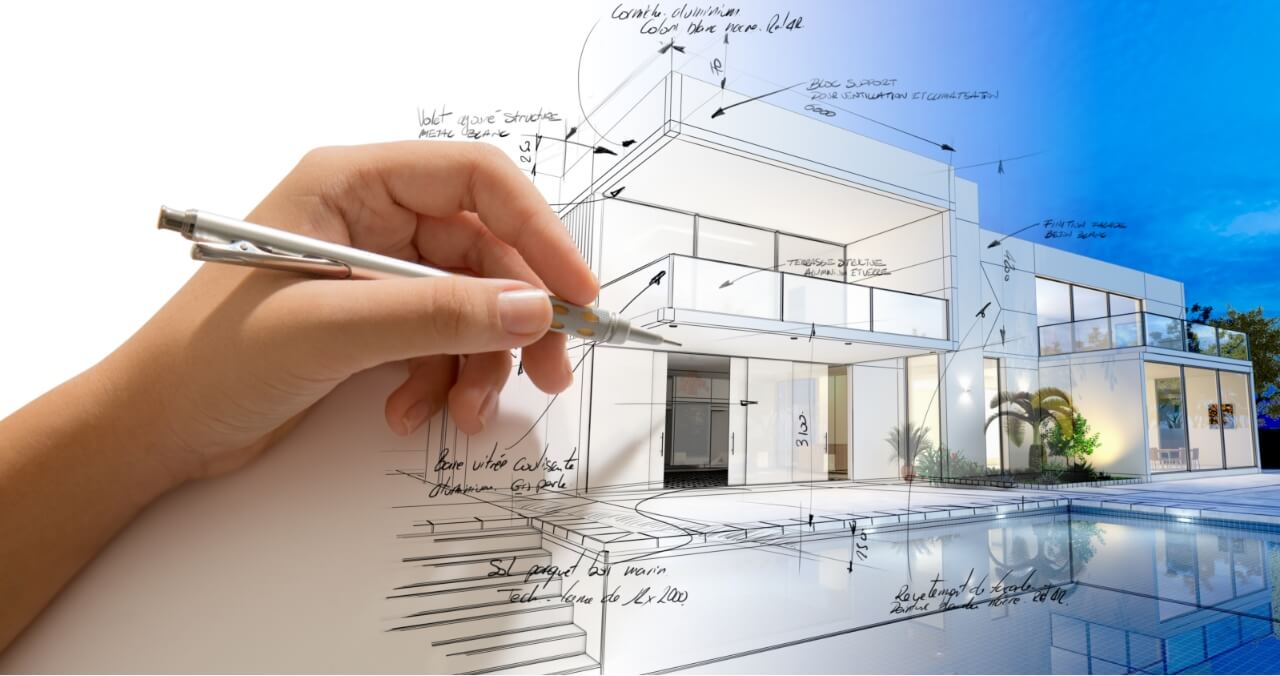

Technology has played a transformative role in modern home building, impacting how companies operate and how investors assess performance. Innovations like 3D printing, modular construction, and smart home technologies have improved efficiency and reduced costs. These trends directly influence the performance of home builder ETFs, as companies adopting new technologies tend to have stronger competitive advantages.

For example, automation in construction reduces labor dependency, while sustainable building materials attract eco-conscious consumers and investors. The digitalization of design and project management also helps companies complete projects faster and more efficiently.

Practical Use and Real-World Applications

Investors can use home builder ETFs as part of a diversified investment strategy. For instance, during economic expansions or periods of rising housing demand, these ETFs often deliver strong returns. They can also complement other real estate investments, such as REITs, by focusing on the construction and development phase rather than property ownership.

Home builder ETFs can also serve institutional investors seeking exposure to cyclical growth sectors. For retail investors, they offer a simplified way to participate in housing market growth without managing multiple individual stocks.

Use Cases: How Home Builder Stocks ETFs Solve Investment Challenges

- Diversification Challenge: For investors who want exposure to housing but don’t want to risk investing in a single company, ETFs solve this by spreading investments across multiple firms.

- Market Entry Barriers: ETFs lower the entry barriers for those who cannot afford large-scale real estate or direct construction projects.

- Economic Cycle Positioning: These ETFs allow investors to capitalize on cyclical trends in housing and construction without overexposure to a single company or market.

Frequently Asked Questions (FAQ)

1. Are home builder stocks ETFs suitable for long-term investment?

Yes. Home builder ETFs can be a valuable long-term investment, particularly for investors seeking exposure to the housing and construction markets, which tend to grow over time with population and infrastructure demand.

2. How do interest rates affect home builder ETFs?

Interest rates play a significant role in home builder ETF performance. Rising rates can reduce housing demand due to higher mortgage costs, while lower rates generally support housing growth and ETF returns.

3. What risks should investors consider before investing in home builder ETFs?

Key risks include exposure to market cycles, interest rate fluctuations, and material cost inflation. Investors should also consider broader economic conditions that can affect housing demand and construction activity.