Invest in Construction Companies: A Strategic Guide for Investors

When we say “invest in construction companies,” we refer to allocating capital via equity, debt, or hybrid instruments into businesses whose core operations revolve around building, infrastructure, contracting, materials supply, or construction technology. These companies span general contractors, specialty trade firms, building-materials manufacturers, modular-construction firms, and firms developing new construction methods.

Investing in these companies differs from simply investing in real estate. While real-estate investment often relates to owning or leasing physical assets, investing in construction companies means participating in the business of creating built assets. That implies exposure to operational risk (project management, cost control, labor), materials risk (prices, supply chain), regulatory risk (permits, codes), and demand risk (cycles in construction). On the flip side, it offers growth potential tied to infrastructure spending, urbanization, technological innovation in building, and modernization of construction practices.

For investors seeking diversified exposure and higher growth potential, construction-company investments may provide a compelling opportunity. However, the complexity of the sector implies that deep understanding and discipline are essential to capturing value and managing risk.

Why Investing in Construction Companies Is Gaining Attention

There are several drivers behind the growing interest in construction-company investments: large global infrastructure deficits, increasing urban growth, the need for building renovation and retrofit, and disruption via technology such as modular construction and digital job-site monitoring. These drivers suggest that firms well-positioned to capitalize on these trends may deliver both revenue growth and value creation.

At the same time, traditional construction operations have often lagged in productivity, leaving room for significant upside if a company can improve margins, adopt technology, and execute projects efficiently. Investors who spot companies that can differentiate on operational excellence or technological edge stand to benefit. Moreover, historically low interest-rate environments and government stimulus directed at infrastructure further bolster the case for construction-company investment as part of a diversified portfolio.

How to Evaluate Construction Company Investments

Business Model & Market Position

Understanding the company’s business model is foundational. Does it function primarily as a general contractor with full project lifecycle risk? Or is it a materials supplier with lower direct risk but greater exposure to commodity prices? Is it a niche specialist (e.g., modular building) or a broad-based builder? Evaluate the company’s competitive advantage: location, scale, specialization, backlog, contract structure (fixed-price vs cost-plus), client concentration, and reputation. A company with a strong backlog in a growth market has an immediate advantage compared to one with minimal backlog in a saturated market.

Market position also includes assessing geographic diversification, regulatory environment, and exposure to large infrastructure projects. A company operating in multiple growing regions or participating in public infrastructure tenders may benefit from broader demand. Conversely, a company narrowly tied to cyclical residential or local commercial markets may have a higher risk.

Financial Health & Risk Profile

Construction companies often have razor-thin margins and face large swings in profitability due to project delays, cost overruns, or contract disputes. A careful investor must analyze the company’s balance sheet: debt levels, working capital management, cash-flow stability, backlog quality, and ability to absorb shocks. For example, companies that take on many fixed-price long-term projects may have greater risk if costs escalate. Meanwhile, firms that rely on subcontractors may face exposure to labor shortages or supply disruptions.

Look for indicators of operational strength: low cost overruns, good project completion records, diversified revenue streams, repeat-client relationships, and effective margin management. Also consider external risk factors such as materials inflation, labor market tightness, regulatory permits, environmental concerns, and macro-economic cycles. In summary, understanding the risk-return profile of the company is critical before investing.

Technology & Innovation Adoption

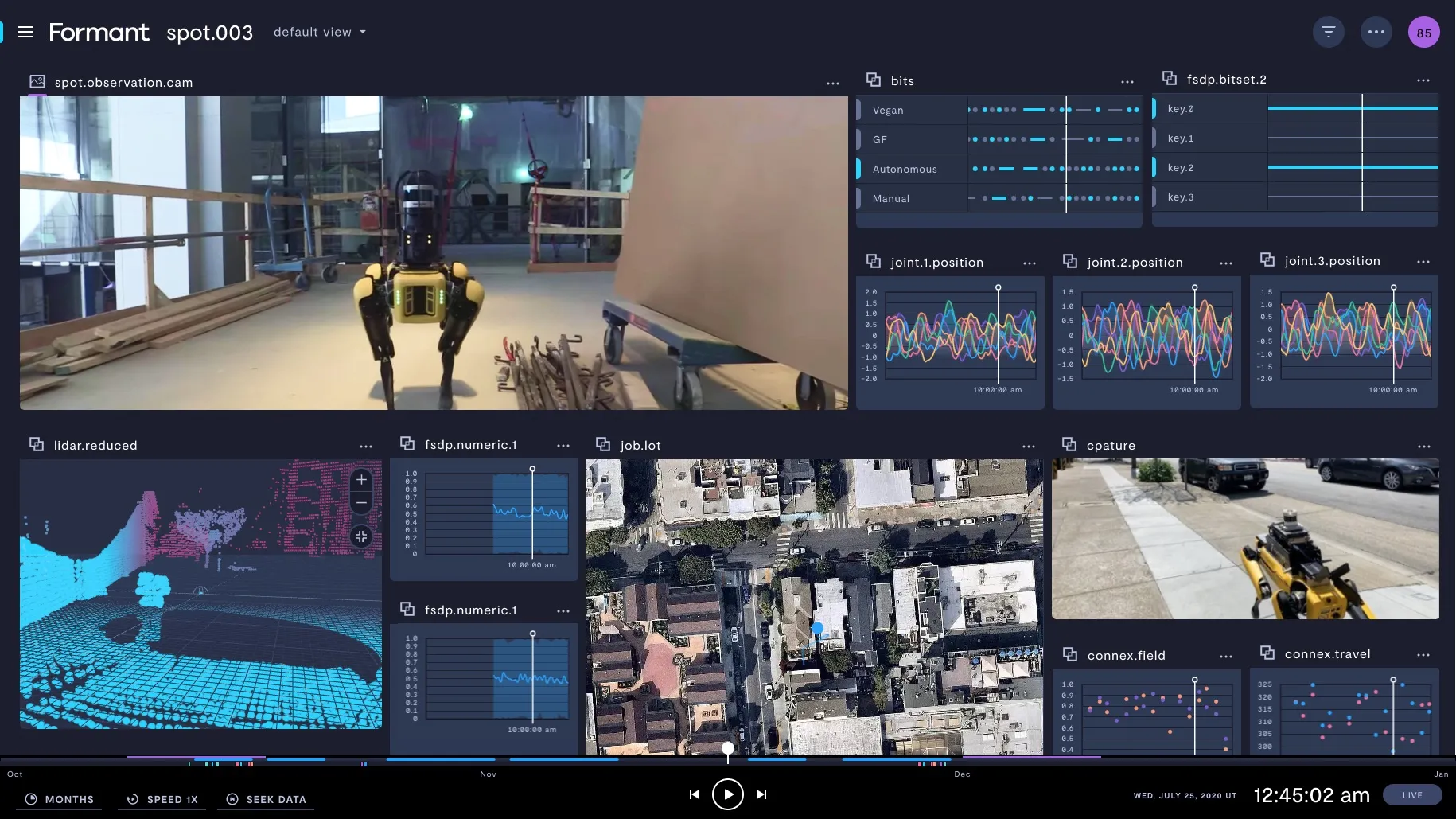

An often-underestimated factor in construction-company evaluation is how well the firm integrates technology and innovation. Companies that adopt digital construction tools (like Building Information Modeling (BIM), drones, robotics, modular prefabrication, and IoT sensors) often gain productivity advantages, better cost control, and improved safety records.

For investors, a company with a forward-thinking technology approach may be less vulnerable to legacy cost issues or labor-intensive risks. The ability to scale via technology adoption may separate winners from laggards in this industry.

Exit & Return Potential

While many investors focus on the entry, it’s equally important to understand how value will be realized. For public-company investments, return may come via share-price appreciation and dividends. For private investments, exit options may include sale to a strategic buyer, recapitalization, or IPO. The construction sector’s cyclical nature means timing can matter; an investor may prefer to enter during a lull and exit into a recovery phase.

Analyze comparable transactions, industry multiples, and potential buyers. Understanding industry norms helps you assess whether a target company is realistically priced and if the investor has an argument of safety.

Real-World Examples of Construction Company Investments

Below are three detailed, real-world use cases of investing in construction companies that illustrate varying strategies, risk profiles, and value drivers.

Large Publicly-Traded Construction Firm

Consider investing in a major publicly traded construction firm that secures infrastructure contracts (bridges, highways, data centers), has diversified geography, and a strong backlog. The investor participates via stock ownership, gaining exposure to large-scale projects and potential growth driven by government infrastructure spending. Such a firm might benefit from economies of scale, established management teams, and the ability to weather downturns.

However, risks include dependence on government contracts, a large fixed-cost base (equipment, workforce), and margin pressure from competition and materials cost inflation. The investor’s return may come over years as projects complete and backlog converts to revenue.

Small to Mid-Size Specialty Trade Contractor

Another example: a private investment into a small-to-mid-sized contractor focused on a niche trade (e.g., high-end HVAC, sustainable building systems). The investor may partner with the owner/operator, inject capital to expand operations, implement technology (project-management software, workflow automation), and grow the business into new markets. After growth, the business may be sold to a larger construction firm or merged.

Here, the value driver is operational excellence, niche specialization, strong client relationships, and the ability to scale. The investor must manage execution risk: subcontractor reliability, labor availability, and margin control.

Construction-Technology Company Serving Builders

A third use case: investing in a company that supplies technology to construction firms, such as modular-construction platforms, job-site robotics, or digital job-site analytics. Investors benefit from the broader trend of construction-industry productivity improvement. The company may be less exposed to project execution risk (instead focusing on product development and commercial technology adoption). The upside is scalability, recurring revenue, and technology-driven differentiation.

The risk is adoption: Construction firms may be slow to adopt new technology, behavior change may be needed, and competitive threats may arise. Nonetheless, this represents a high-growth path if the company becomes integral to the construction lifecycle.

Benefits of Investing in Construction Companies

Growth Opportunity via Infrastructure & Urbanization

Construction companies stand to benefit from global megatrends: urbanization, infrastructure renewal, climate-change-driven rebuilds, and commercial real-estate expansion. As governments and the private sector allocate large sums to infrastructure and construction, companies positioned in strong markets may enjoy above-average growth. For the investor, this means potential for revenue growth and value creation beyond passive assets.

Diversification Beyond Traditional Asset Classes

Since construction companies combine elements of industrial operations, real-estate execution, and project management, investing in them can provide diversification away from pure equities or real estate. The risk-return profile is distinct; it involves operational risk but also tangible asset and project exposure.

Productivity Gains through Technology Adoption

Companies that adopt technology such as modular building, prefabrication, job-site automation, and analytics may generate higher margins, faster project delivery, fewer cost overruns, and stronger competitive positioning.

Potential for Exit Premium and Value Realization

Construction companies with a backlog, modern operations, and scalability may attract strategic buyers or command premium valuations. Because the construction sector historically suffers from inefficiency, a company that differentiates itself may be more valuable.

Impact and ESG Alignment

Investing in construction companies also offers an opportunity to align with environmental, social, and governance (ESG) themes such as sustainable building and infrastructure resilience. For investors focused on long-term responsible investing, this sector offers tangible ways to achieve impact while seeking financial return.

Practical Use Cases: What Problems Do Construction-Company Investments Solve?

Use Case 1: A Mature Construction Company Lacking Growth Capital

Problem: A regional contractor has a strong track record but lacks capital to expand into new markets or adopt digital project-management systems.

Solution: An investor injects equity, enabling expansion, better systems, and acquisitions.

Why it’s useful: Revenue increases and margins improve via better management.

Use Case 2: A Construction Company Operating with Outdated Processes

Problem: A firm still relies on manual scheduling, paper-based systems, and has high delays.

Solution: Investment enables technology adoption—digital scheduling, sensors, prefab systems, and workforce training.

Why it’s useful: Improves efficiency, competitiveness, and profitability.

Use Case 3: A Construction Technology Firm Facing Capital Constraints

Problem: A tech firm developing modular-construction systems or robotics lacks growth capital.

Solution: Investor provides capital, connects with large contractors, and supports market rollout.

Why it’s useful: The tech firm scales and investors gain from innovation-driven growth.

Risks, Challenges, and Key Cautions

Execution and Project Risk: Delays, cost overruns, safety incidents, and disputes are common.

Cyclicality: Construction demand depends on macroeconomic conditions and interest rates.

Cost Inflation: Materials and labor prices may rise unexpectedly.

Regulatory Risk: Permits, zoning, and environmental regulations can cause delays.

Technology Risk: New tech may be slow or costly to implement.

Exit Risk: Market timing affects valuation and buyer demand.

Summary and Strategic Investor Takeaways

Investing in construction companies offers a unique intersection of industrial operations, project execution, and technology-enabled growth.

Key takeaways for investors:

-

Evaluate business model, backlog, and management quality.

-

Assess financial health and technology adoption.

-

Recognize cyclical trends and manage timing.

-

Benchmark against real-world examples.

-

Ensure the exit strategy is clear and realistic.

For disciplined investors, this sector offers strong long-term potential when approached with analysis and patience.

Frequently Asked Questions

1. What are the main ways to invest in construction companies?

You can invest via public equities, private equity, venture capital, or debt financing, depending on your risk profile and liquidity needs.

2. What factors should I prioritize when selecting a construction company investment?

Focus on management quality, backlog strength, technology use, financial stability, and a clear exit pathway.

3. How does technology impact investment outcomes in construction companies?

Technology enhances productivity, cost control, and safety. Firms leveraging innovation tend to outperform peers over time.